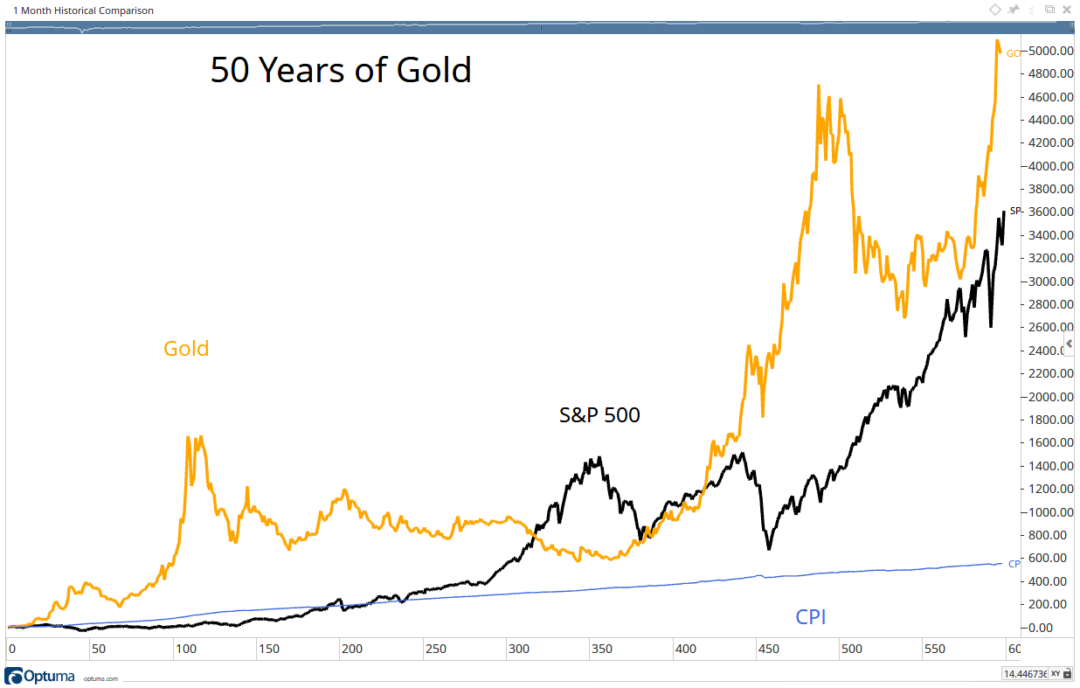

Gold vs. Stocks Why the Precious Metal Could Win Over Next 50 Years

Our curated list of the best gold stocks is built using strict criteria. The stocks outlined above are traded on U.S. or Canadian stock exchanges and meet the following requirements: Gold revenue. All companies generate at least half of their annual revenue from gold. High solvency ratios. » Read more about: 8 Best Gold Stocks Of 2023 »

The Gold Price Forecast for 2023 Invest in Gold YouTube

In this article, we discuss the 13 most profitable gold stocks to invest in. To skip the detailed analysis of the industry, go directly to the 5 Most Profitable Gold Stocks To Invest In. The close.

Gold Price Forecast for 2023, 2025, 2030 and Beyond

Gold is typically a safe haven investment that offers stability during challenging economic conditions. The asset typically has a low correlation with the stock, bond, and crypto markets, so it's prudent to invest in the best gold stocks now. 2022 was an incredibly tough year for financial markets. The S&P 500 dipped 19.4%, while the crypto market and 30-Year U.S. Treasury Bond futures shed.

Strike Gold in 2023 Discover the Best Gold Stocks

2. Equinox Gold (TSX:EQX) Company Profile. Year-to-date gain: 50.76 percent; market cap: C$2.1 billion; current share price: C$6.95. Equinox Gold is a mid-tier gold producer that operates seven.

Gold Mining Stocks to Watch in 2023 CMC Markets

Here are three key bullish price drivers for gold in 2023. 1. New central bank purchases (especially from China) World Gold Council. This is the #1 thing to watch in the gold markets in 2023 in my.

5 Best Gold Stocks to Buy Right 2023 Guide

For this article we scanned Insider Monkey's database of 910 hedge funds and picked 12 dividend-paying gold stocks with the highest number of hedge fund investors. Some top names in the list.

6 Best Gold Mining Stocks To Buy In 2023 YouTube

With a low PE ratio and a dividend yield of about 2.8%, gold mining company Gold Fields Limited (NYSE:GFI) ranks 12th in our list of the best gold stocks under $25. As of the end of the third.

The Top Gold Mining Penny Stocks to Add to Your Watchlist in 2023

Paul Harris of the Mining Journal and Jeff Clark of GoldSilver.com present the gold stocks they currently see with the most upside potential for 2023.#gold #.

5 Best Gold Stocks to Buy Right 2023 Guide

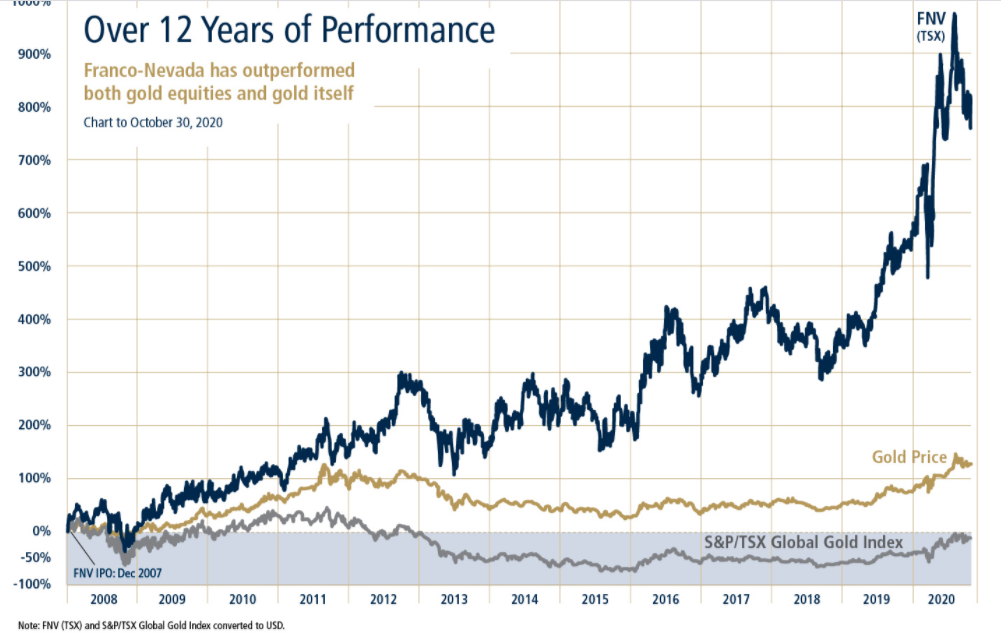

1. Barrick Gold Corporation. 2. Franco-Nevada Corporation. 3. VanEck Vectors Gold Miners ETF. Gold stocks are publicly traded investments focused on gold. The industry consists of the following.

Best Gold Stocks To Buy Right Now Gold Choices

With its 21% ascent, GFI is one of the hotter gold stocks this year. But the stock has struggled in the second half of 2023, its share price sliding to $12.24 from a high of $17.78. The company's.

gold mining stocks list Choosing Your Gold IRA

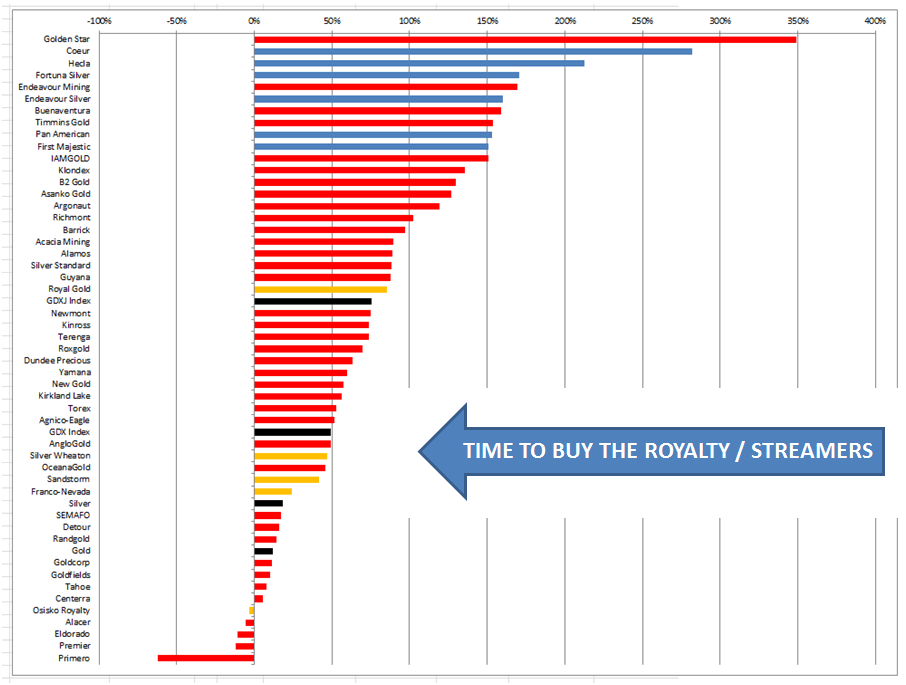

15. 13. Sandstorm Gold Ltd.: Sandstorm Gold is a royalty company that provides financing for gold miners in exchange for the right to a percentage of the gold produced from mines. The company has.

8 Best Gold Stocks to Buy in 2021

The Best Gold Stocks of March 2024. Company (Ticker) Market Cap. Wheaton Precious Metals Corp (WPM) $20.1 billion. Gold Fields Limited (GFI) $13.7 billion. Alamos Gold Inc. (AGI) $5.3 billion.

Gold Starts 2023 With a Bang. Here's the View on the Chart. TheStreet

7 Best-Performing Gold Stocks: April 2024. The dollar has lost a lot of purchasing power in recent years, while gold has increased in price. Gold stocks provide a potential way for investors to.

Investing in gold vs. stocks Which is better? CBS News

These are the 5 Best Gold stocks to buy in April 2024, according to Wall Street analysts. Currently, gold prices are hovering around $2,200 per ounce. Since December 2023, gold prices have been on.

23 Top Stocks to Buy for 2023! Best Stocks to Buy in 2023 Top Stock

8 Best Gold Stocks To Invest In for 2023. Here are eight gold mining companies that appear to be rated as "buys" right now by experts. 1. Barrick Gold. Market Cap: $28.61B. YTD Return: -5.12%. Barrick Gold is one of the most established names in the gold industry.

The Six Best Gold Stocks to Buy Now in 2020 Trading Tips

Lundin processed 1.65 million tons of ore in fiscal 2023, up more than 6%. Lundin also produced 481,274 ounces of gold last year, up 1% YoY. Looking ahead to 2024, the company is planning its.