what are the federal withholding rates for 2020 Federal Withholding

Rich Uncles. If a rich uncle dies in 2013 and his $6 million life insurance names you as the beneficiary, federal estate taxes are due. Assuming he did not also include you in his will -- and because for 2013 $5.25 million is exempt -- you'll owe taxes on $750,000. The federal estate tax rate is 40 percent. Therefore, you should withhold $300,000.

Annual federal withholding calculator KerstinKeisha

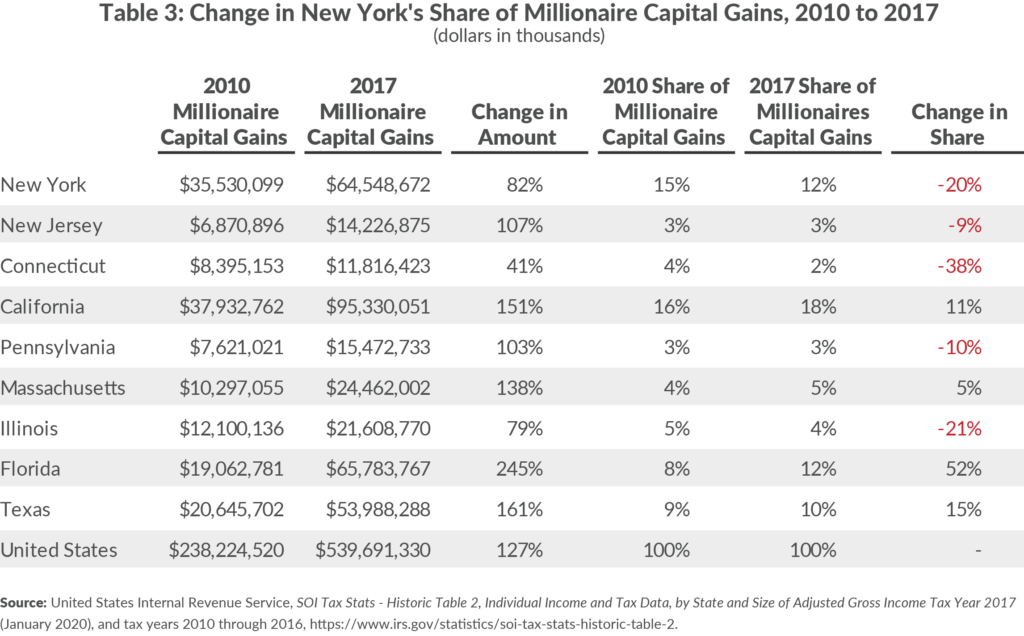

You have a large amount of taxable capital gains from the sale of a property, mutual funds, or stock. You take withdrawals from an IRA or 401 (k) account. You and/or a spouse start receiving Social Security benefits. You reach age 72 (or age 70 1/2 if you reached 70 1/2 before January 1, 2020), and required IRA distributions begin.

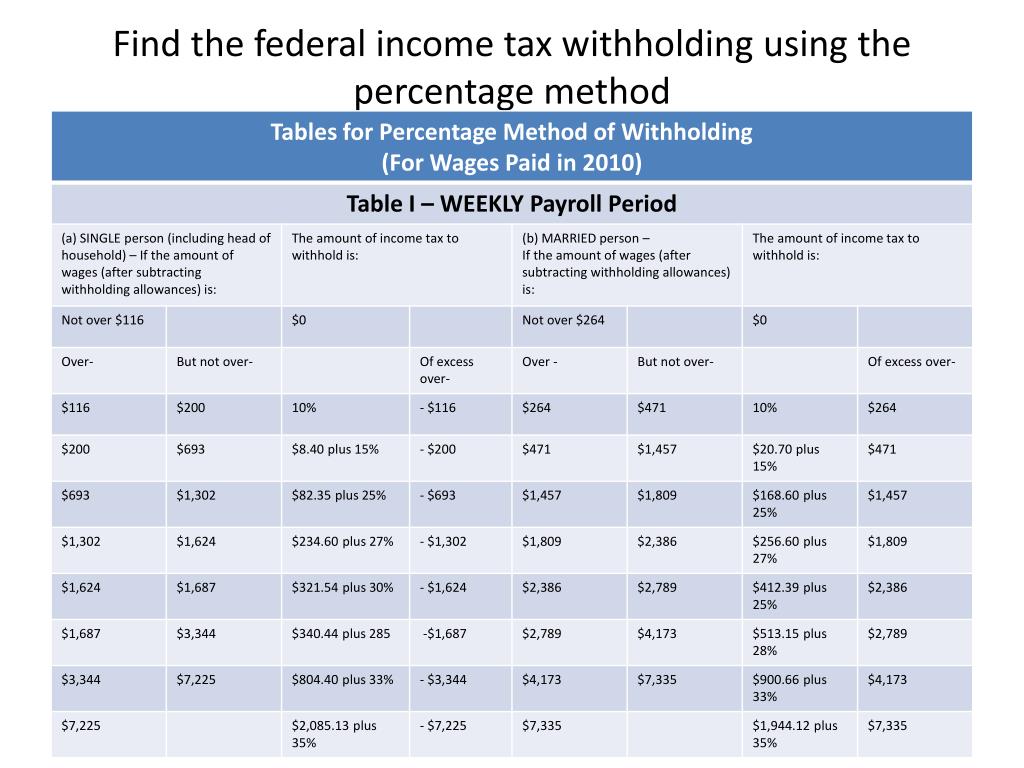

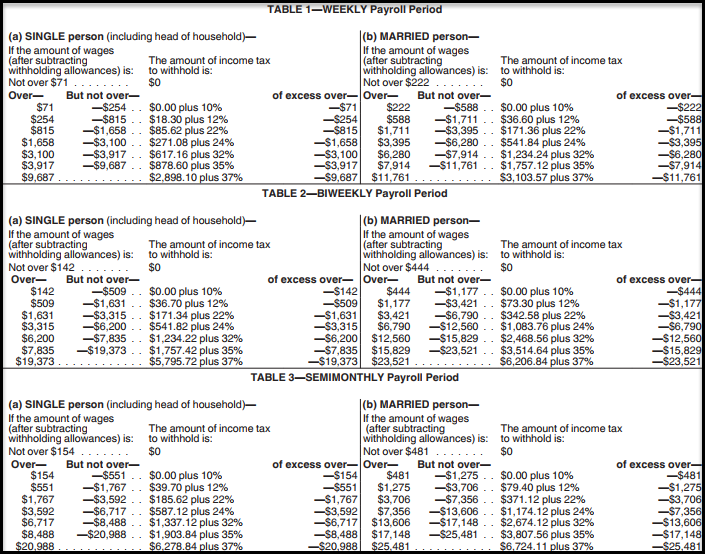

IRS Tax Charts 2021 Federal Withholding Tables 2021

FICA contributions are shared between the employee and the employer. 6.2% of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6.2%. However, the 6.2% that you pay only applies to income up to the Social Security tax cap, which for 2023 is $160,200 ($168,600 for 2024).

IRS Tax Brackets 2021 Table Federal Withholding Tables 2021

For example, if you plan to make $40,000 in IRA distributions and have $20,000 in social security income with the standard deduction, your taxes owed will be about $4,736 using the 2023 calculator.

Employees Should Know These Three 2020 Tax Numbers

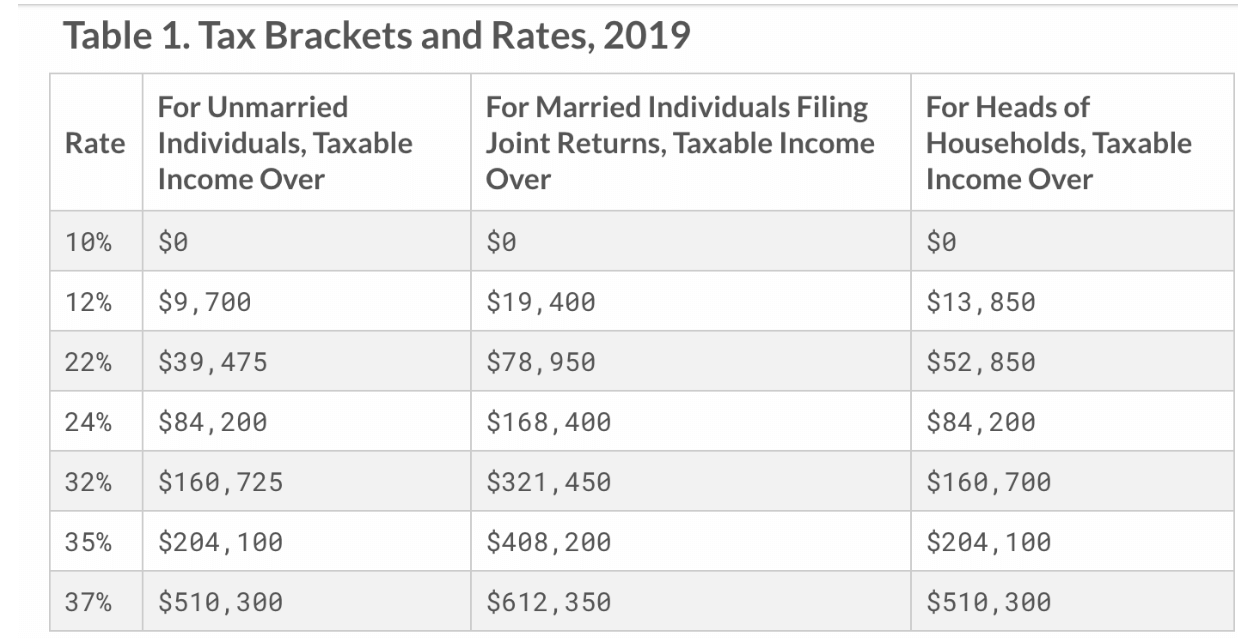

The 2023 tax year—meaning the return you'll file in 2024—will have the same seven federal income tax brackets as the last few seasons: 10%, 12%, 22%, 24%, 32%, 35% and 37%. Your filing.

How to Read Your Paycheck Everything you need to know Chime

1 Answer. Whether or not you should withhold taxes when surrendering/canceling your life insurance policy depends on your specific situation. Generally, if you cancel a life insurance policy and receive a payment that is greater than the amount you paid in premiums, you may be subject to taxation on the excess amount as income. However, if you.

Texas Withholding Tables Federal Withholding Tables 2021

There are seven federal income tax rates and brackets for 2023 and 2024: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. Your taxable income and filing.

What is Tax Withholding? All Your Questions Answered by Napkin Finance

The federal income tax rates remain unchanged for the 2023 tax year at 10%, 12%, 22%, 24%, 32%, 35% and 37%. The income thresholds for each bracket, though, are adjusted slightly every year for inflation. Here's a breakdown that will show the differences between tax year 2023 (filed by April 15, 2024) and tax year 2024 (filed by April 15, 2025).

Revised Withholding Tax Table Bureau of Internal Revenue

In 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (Table 1). There are seven federal income tax rates in 2022: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. The top marginal income tax rate of 37 percent will hit taxpayers with taxable.

Withholding Tax Charts For 2021 Federal Withholding Tables 2021

As your income goes up, the tax rate on the next layer of income is higher. When your income jumps to a higher tax bracket, you don't pay the higher rate on your entire income. You pay the higher rate only on the part that's in the new tax bracket. 2023 tax rates for a single taxpayer. For a single taxpayer, the rates are:

Publication 15 Federal Tax Withholding Tables Federal Withholding

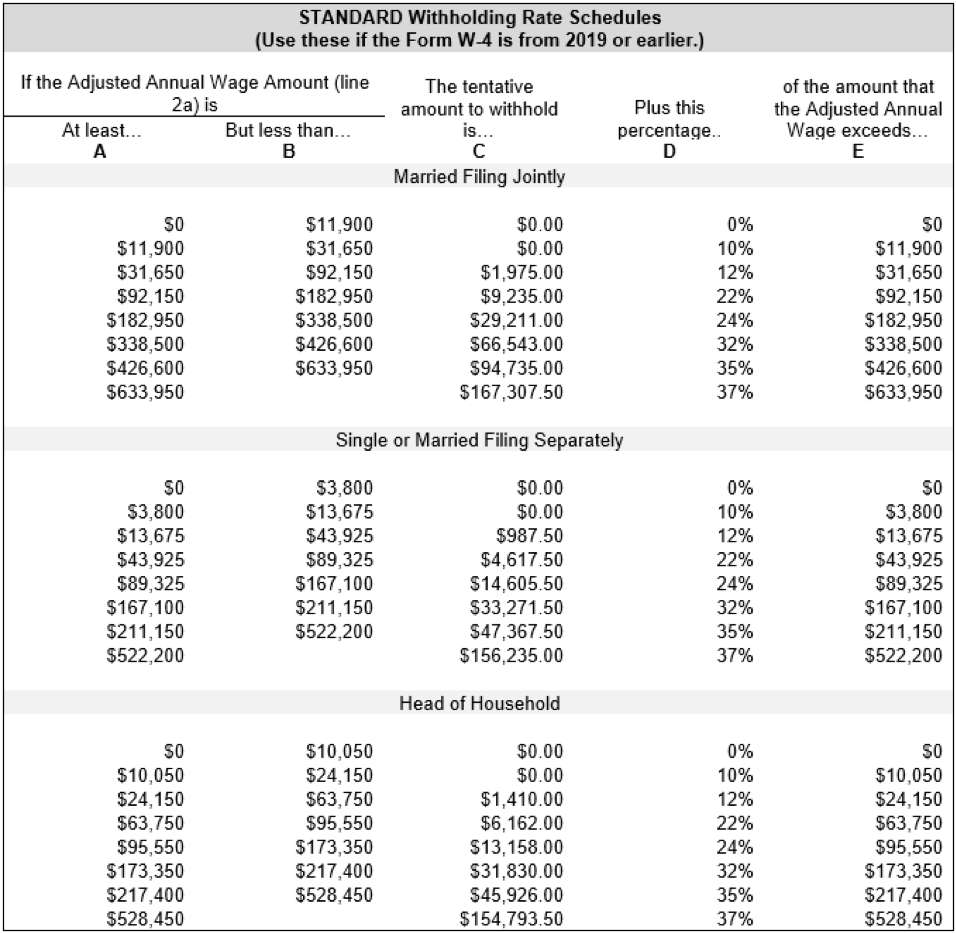

What most people think of the bonus tax rate is actually a percentage of tax withheld from pay in certain circumstances: prizes and awards, certain commissions, overtime pay, back pay, and reported tips. The bonus tax withholding rate is a flat 22% as long as the amount paid is under $1 million.

Federal Tax Withholding Employer Guidelines and More

If you earn over $200,000, you can expect an extra tax of .9% of your wages, known as the additional Medicare tax. Your federal income tax withholdings are based on your income and filing status.

Federal Tax Withheld Tax Rate 2021 Federal Withholding Tables 2021

Estimate your US federal income tax for 2023, 2022, 2021, 2020, 2019, 2018, 2017, 2016, or 2015 using IRS formulas. The calculator will calculate tax on your taxable income only. Does not include income credits or additional taxes. Does not include self-employment tax for the self-employed. Also calculated is your net income, the amount you.

2024 Federal Tax Chart Rasia Peggie

Tax Tip 2022-66, April 28, 2022 — All taxpayers should review their federal withholding each year to make sure they're not having too little or too much tax withheld. Doing this now can help protect against facing an unexpected tax bill or penalty in 2023.

How To Find Medicare Tax Withheld

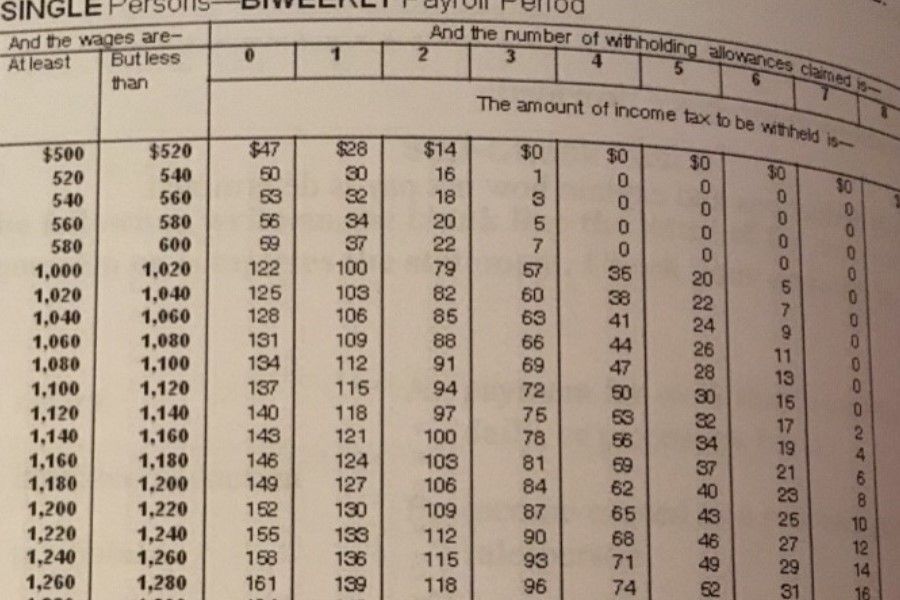

Use this tool to: Estimate your federal income tax withholding. See how your refund, take-home pay or tax due are affected by withholding amount. Choose an estimated withholding amount that works for you. Results are as accurate as the information you enter.

Tax Withholding Tables Federal Withholding Tables 2021

What is an effective tax rate? In 2023 and 2024, there are seven federal income tax rates and brackets: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Taxable income and filing status determine which.