Can I Sue My Employer For Not Paying Me? Wage Violations

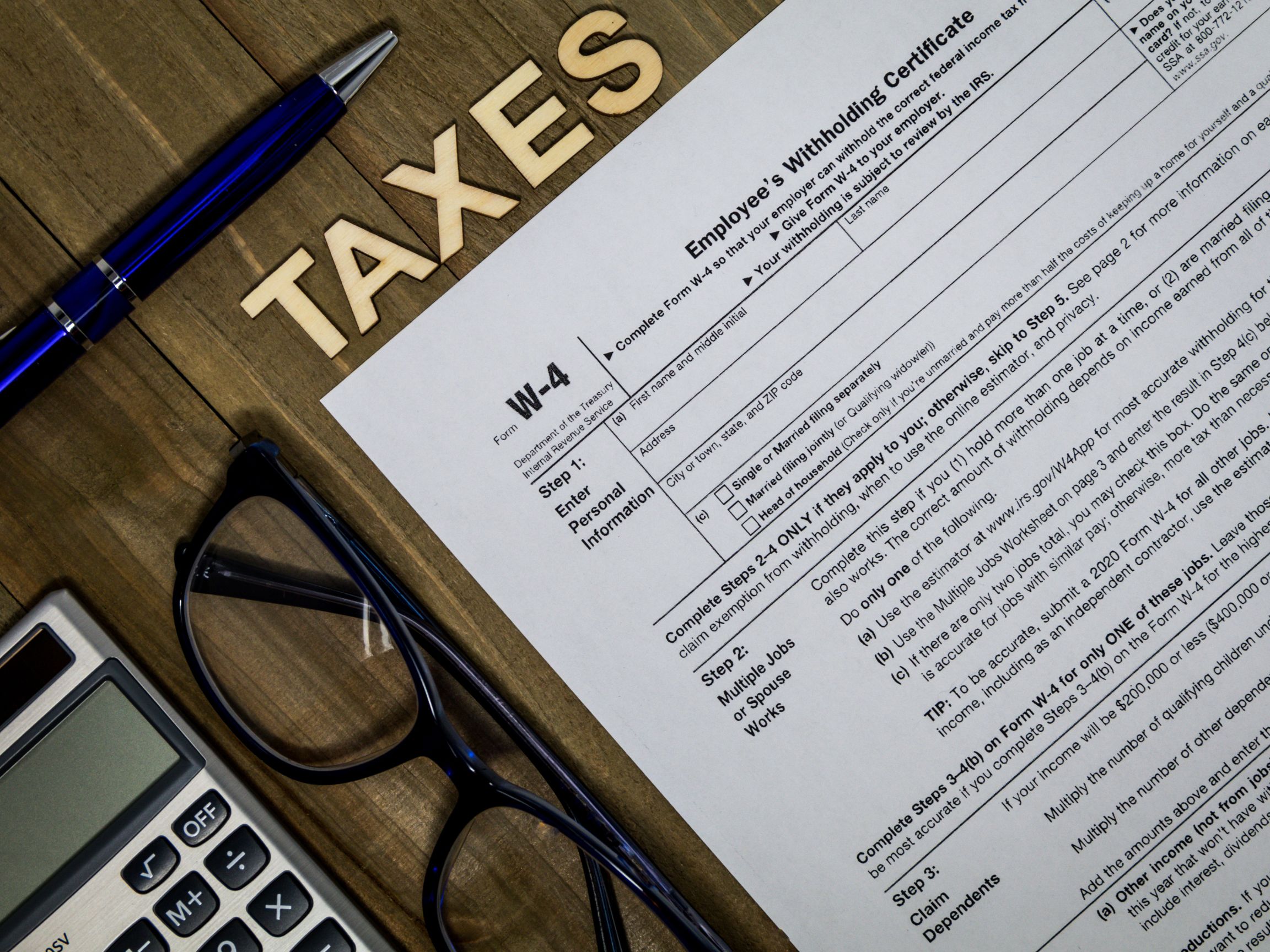

To make sure your withholding is more accurate next year, you can fill out an updated Form W-4 and send it to your employer. A Form W-4 is really straightforward. All you'll need is: Contact information (like name and address) Filing status. How many dependents you'll claim. The total value of deductions you plan to claim.

Federal Tax Are You Withholding Enough? Focus HR Inc.

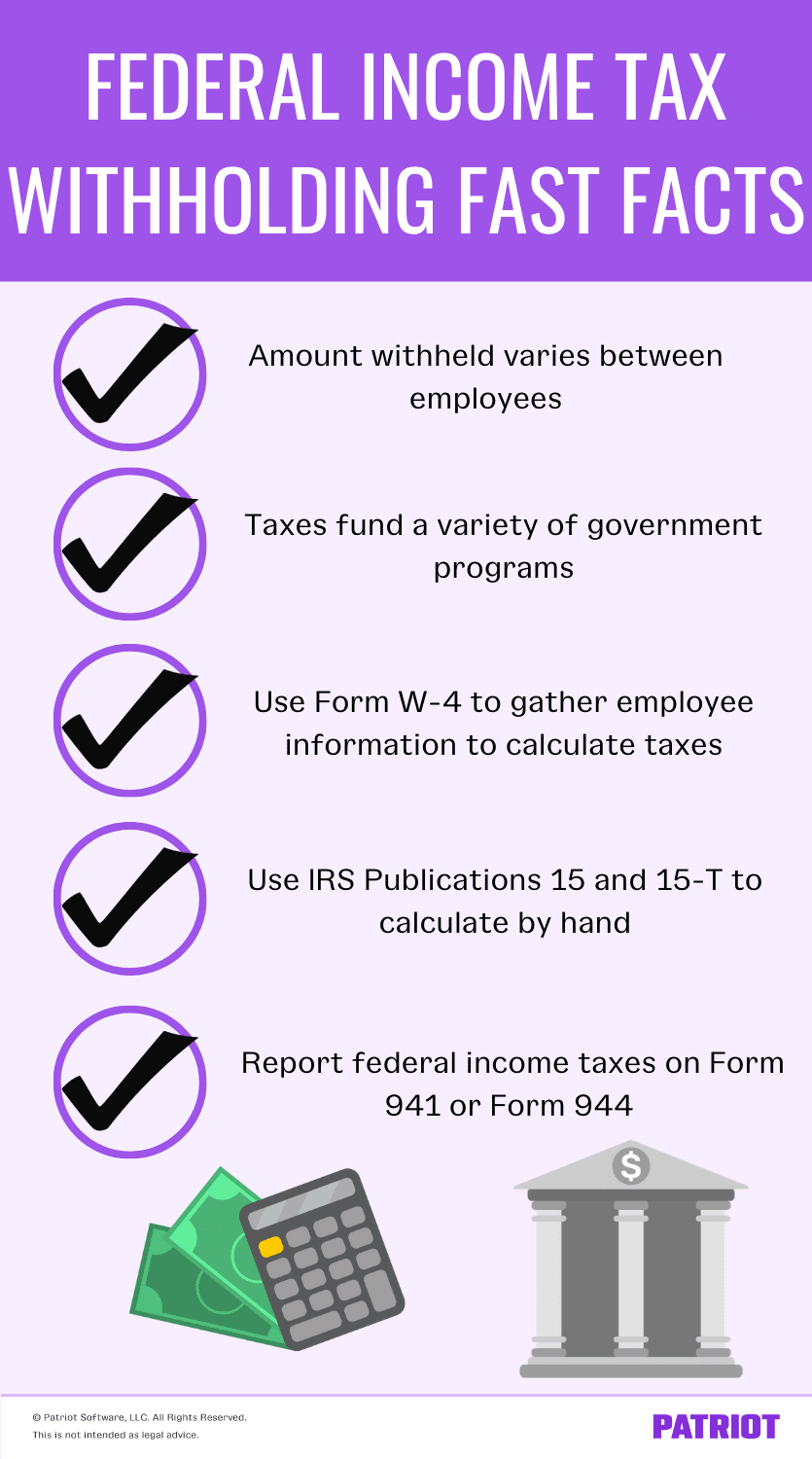

The amount withheld depends on: The amount of income earned and. Three types of information an employee gives to their employer on Form W-4, Employee's Withholding Allowance Certificate : Filing status: Either the single rate or the lower married rate. Number of withholding allowances claimed: Each allowance claimed reduces the amount withheld.

Why Did My Employer Not Take Out Federal Tax? Here's What to Do

Reason #1 - The employee didn't make enough money for income taxes to be withheld. The IRS and other states had made sweeping changes to employee withholding along with the change of the employee W-4 in 2020. The new W-4 reflect changes to the federal tax code from the Tax Cuts and Jobs Act. The IRS says the redesign was made to have.

Average Federal Tax Rates By Group Are Highly Progressive

In some situations, taxes might have actually been withheld but the person was given the wrong W-2. In this case, the employer is required to issue a corrected W-2. If the employer made a mistake.

50 Shocking Facts Unveiling Federal Tax Deductions from Paychecks 2023

complete a new Form W-4P, Withholding Certificate for Pension or Annuity Payments, and submit it to your payer. make an additional or estimated tax payment to the IRS before the end of the year. Page Last Reviewed or Updated: 01-May-2023. All the information you need to complete a paycheck checkup to make sure you have the correct amount of.

2022 Federal Effective Tax Rate Calculator Printable Form, Templates

Typically, an underpayment penalty may apply if the amount withheld (or paid through estimated taxes) is not equal to the smaller of 90% of the taxes you owe for the current year or 100% of the.

8 Reasons To Hire Someone To Help With Your Tax Planning Black

1) Make a quarterly estimated tax payment totaling 100% of their previous year's tax liability for that period. 2) Make a quarterly estimated tax payment totaling 90% of the current year's.

9 tips to help you file your federal taxes

When an employer fails to withhold PAYGW amount, they can write to us to make a voluntary disclosure. This gives them an opportunity to correct the tax obligations. There is always an option for you to make voluntary payments to your Income tax account to the ATO which can be used to pay off the future income tax debt.

Federal Tax Withholding Employer Guidelines and More

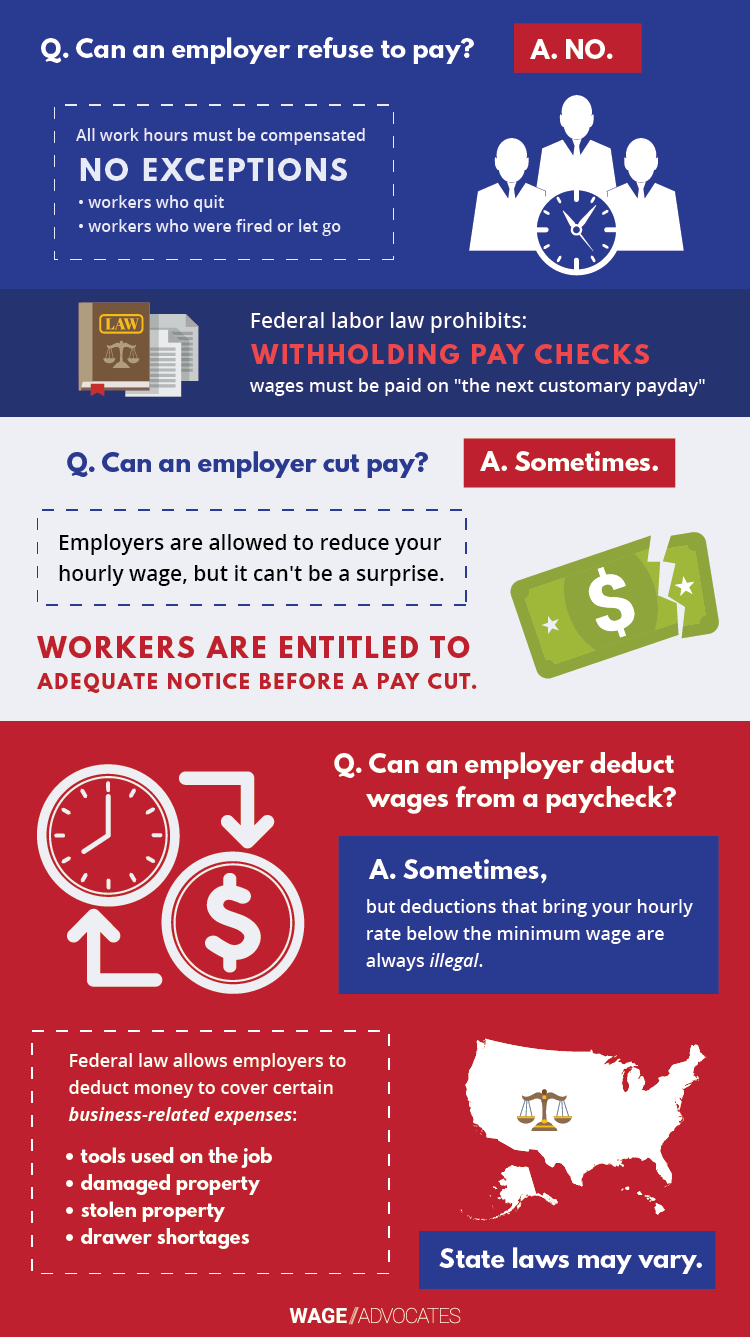

Sec. 6672 (a) imposes a 100% civil penalty on responsible officers in cases of failure to withhold and/or pay over employment taxes. Sec. 7202 makes failing to meet employment tax obligations a felony, punishable by a fine of not more than $10,000, prison for up to five years, or both.

Why Did My Employer Not Take Out Federal Tax? Here's What to Do

If your employer didn't take out enough, you'll owe on April 15. If your employer took out too much, you'll get a refund. Unfortunately, you may not realize your employer isn't withholding.

Federal Tax Withholding Tables Calculator

Medicare and Social Security. While you have will have Medicare and Social Security taxes withheld from your paycheck, your employer is also responsible for paying his share of these taxes. He must pay this money directly to the IRS. If your employer does not pay his share of Medicare and Social Security taxes, it is his responsibility to make.

Why Was Federal Withholding Not Taken From My Paycheck?

Until the employee furnishes a new Form W-4, the employer must withhold from the employee as from a single person. If, however, a prior Form W-4 is in effect for the employee, the employer must continue to withhold based on the prior Form W-4. Q9: I heard my employer no longer has to routinely submit Forms W-4 to the IRS.

Why Did My Employer Not Take Out Federal Tax? Here's What to Do

Incorrect W-4 Allowances. Your employer bases your federal tax withholding on your tax filing status and the number of personal allowances claimed on your W-4. The more allowances you claim, the.

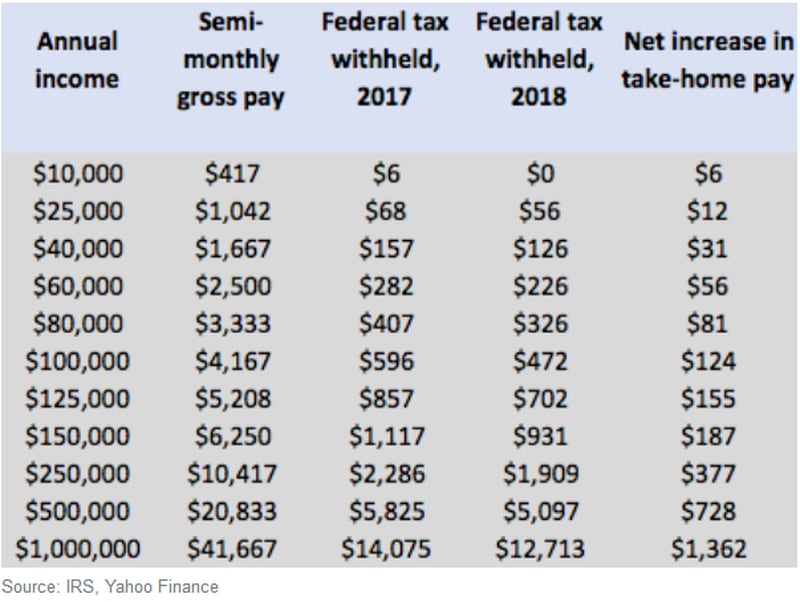

Here's why there's more money in your paycheck

Scenario A - employer withholds income tax from your pay cheques. Let's say the correct amount was $1,500. You would have been paid $1,500 less during the year. Scenario B - employer withholds $0 of income tax from your pay. You pay CRA $1,500 at tax time. In both scenarios you ended up with the same amount paid to CRA.

Payroll Taxes 101 What Employers Need to Know Workest

The Federal Income Tax is a tax withheld by the IRS from your paycheck, applying to various forms of income such as employment and capital gains. It helps fund government programs and infrastructure. Reasons for not paying federal income tax include earning below the threshold, being exempt, living and working in different states with tax.

What is Tax Withholding? All Your Questions Answered by Napkin Finance

If your employer refuses to fix the insufficient withholding, report it to the IRS. Federal withholding refers to the federal income tax and Social Security and Medicare taxes your employer is supposed to take out of your earnings. If enough federal taxes are not withheld, you'll likely owe the Internal Revenue Service when you file your tax.