Budget Basics Who Pays Taxes?

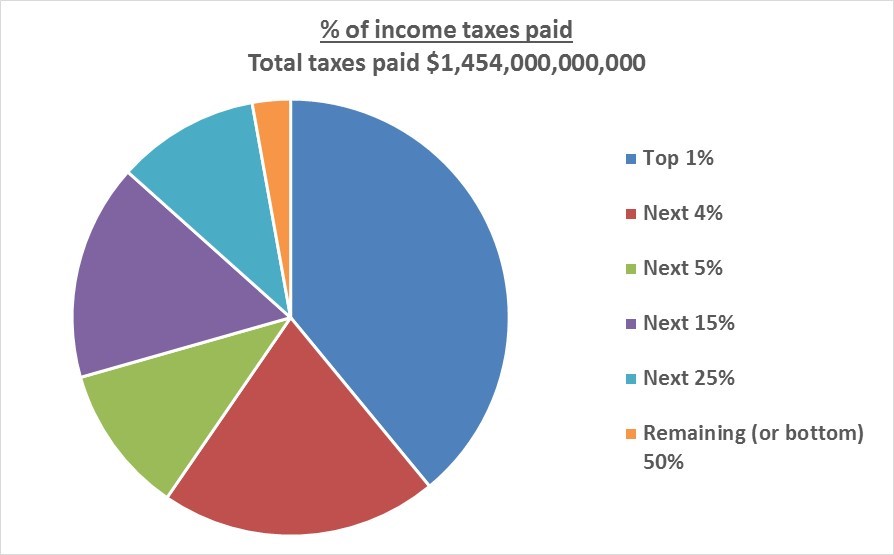

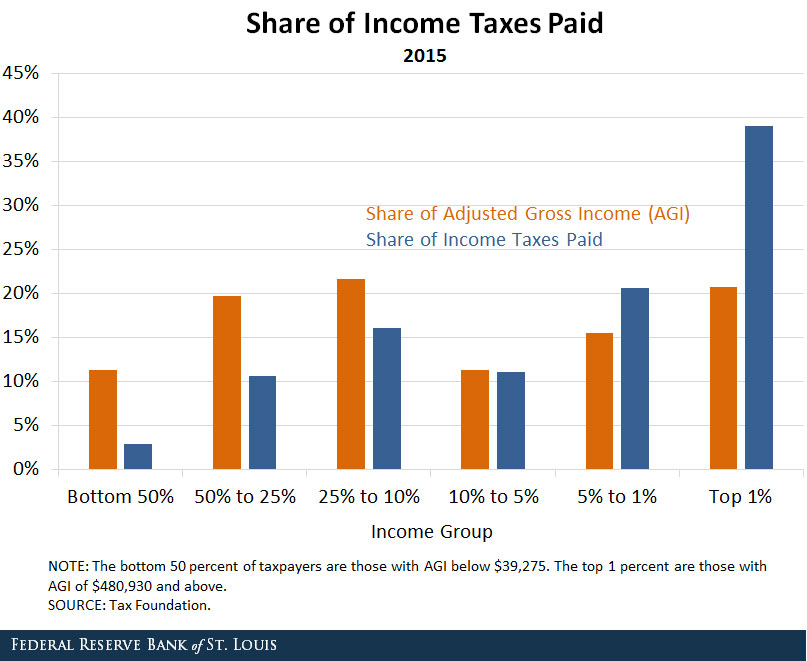

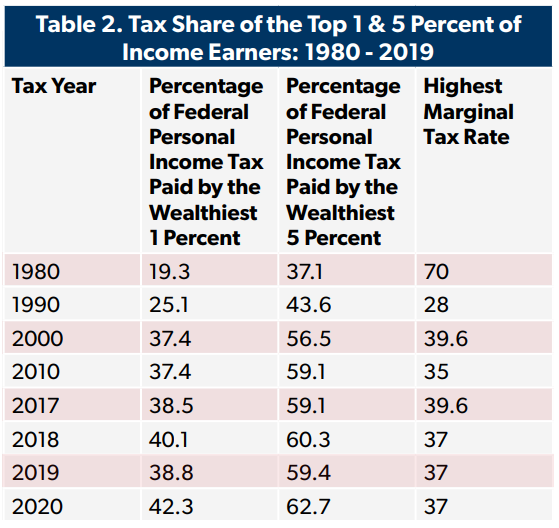

Taxes paid rose to $1.6 trillion for all taxpayers in 2017, an 11 percent increase from the previous year. The average individual income tax rate for all taxpayers rose from 14.2 percent to 14.6 percent. The share of income earned by the top 1 percent rose from 19.7 percent in 2016 to 21.0 percent in 2017, and the share of the income tax burden.

Who pays the tax Withum

Taxes are generally an involuntary fee levied on individuals or corporations that is enforced by a government entity, whether local, regional or national in order to finance government activities.

Budget Basics Who Pays Taxes?

Here's Who Pays The Most. A large chunk of the income tax in the U.S. is paid by a small slice of the population. Now that you've paid your income taxes or are about to, let's look at the.

CBO's Analysis of the Distribution of Taxes20160212

179. Mark Henricks. March 5, 2024 · 5 min read. who pays the most taxes. Most income taxes in the United States are paid by the people with the most income. That is in keeping with the generally.

Who Pays Taxes in America in 2019? ITEP

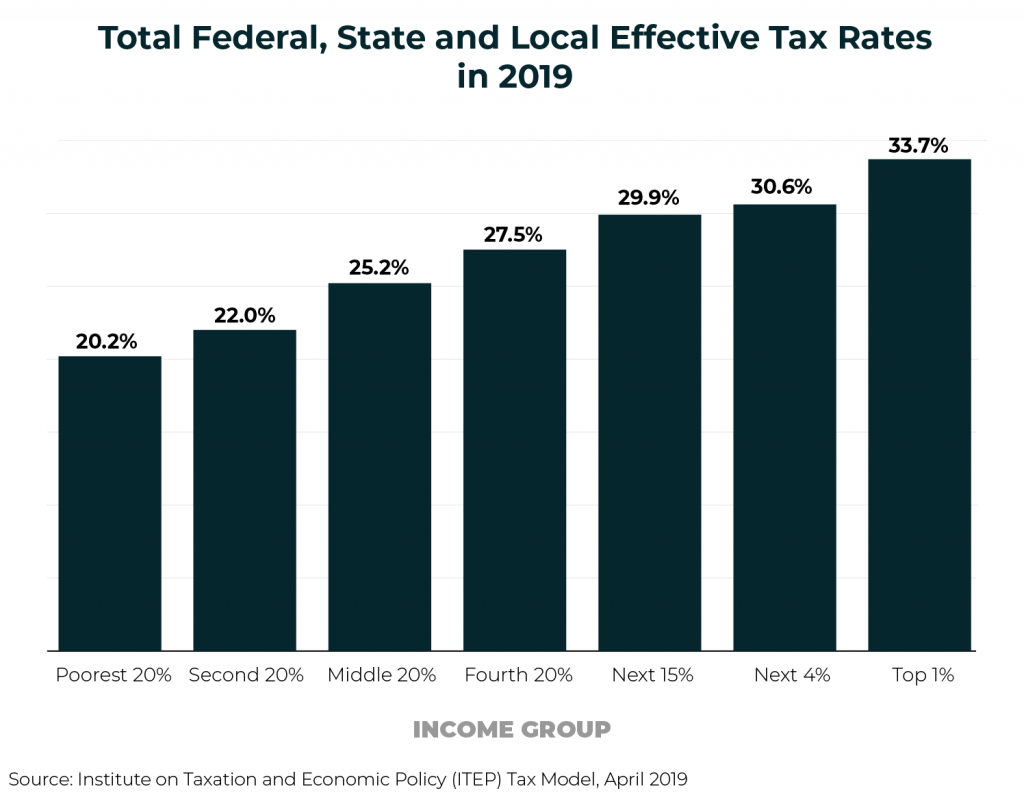

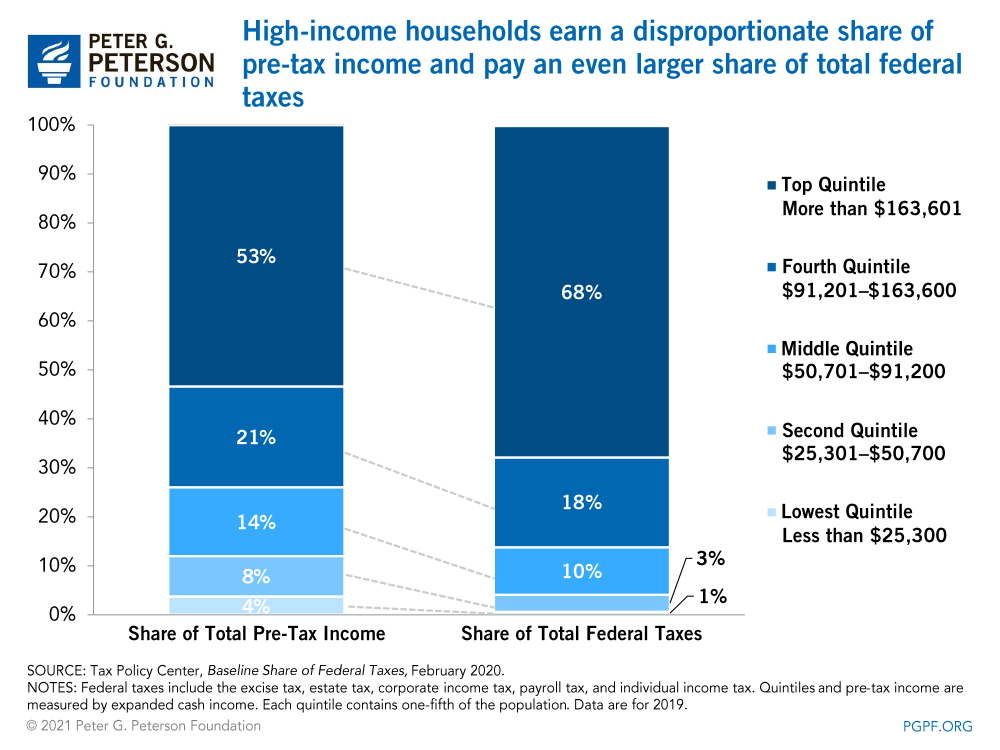

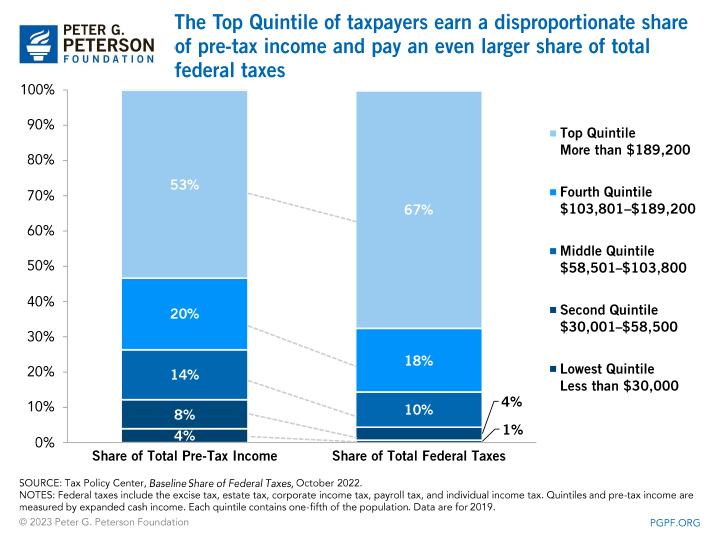

Here's who pays the most. The highest-earning Americans pay the most in combined federal, state and local taxes, the Tax Foundation noted. As a group, the top quintile — those earning $130,001.

Who Pays Taxes, and How Much? St. Louis Fed

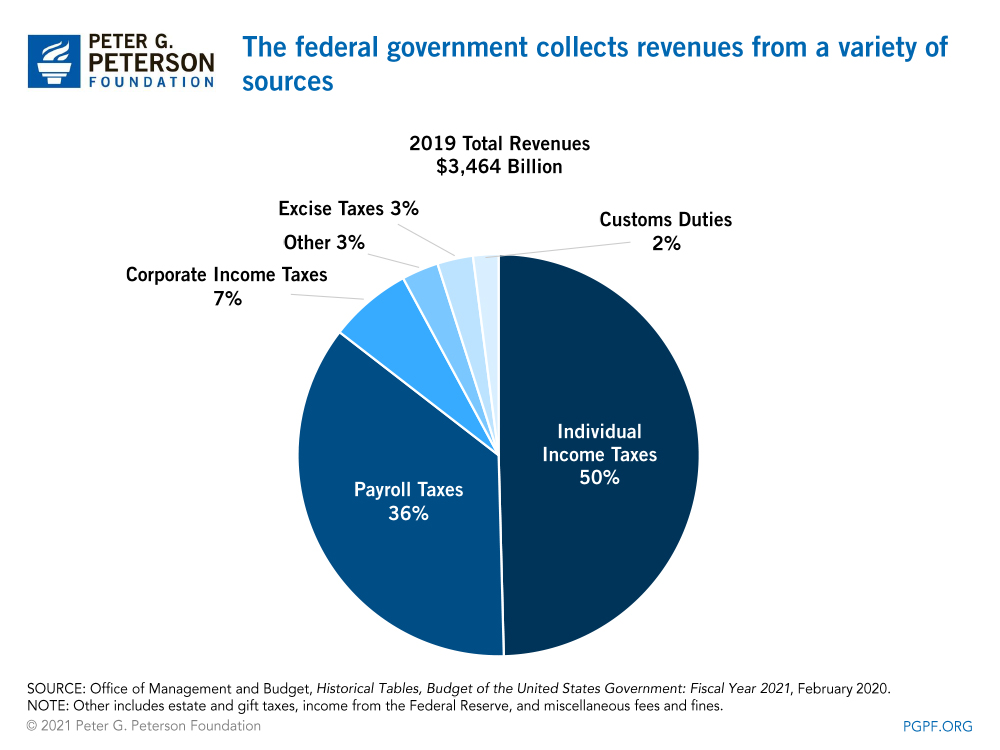

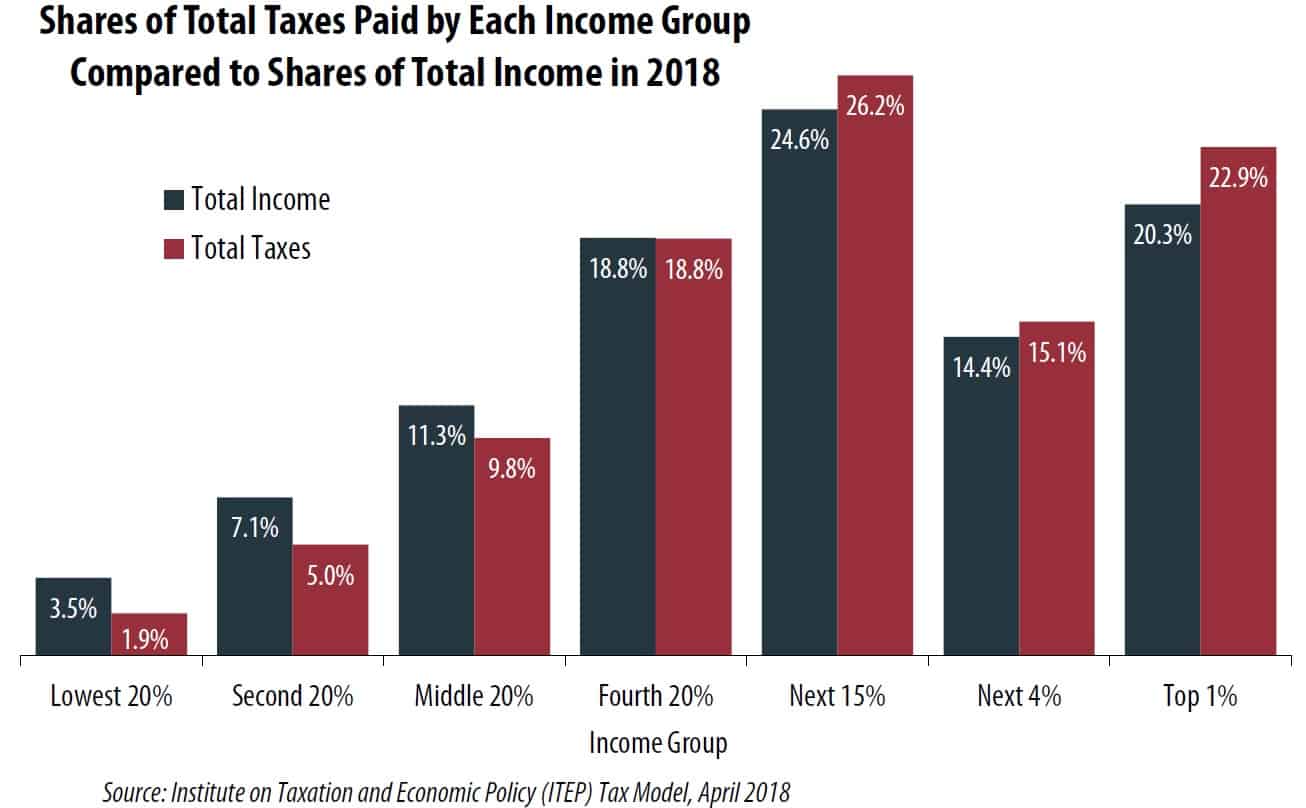

Most income taxes in the United States are paid by the people with the most income. That is in keeping with the generally progressive nature of the individual federal income tax, the primary source of government revenues, which applies higher tax rates to higher incomes. However, some taxes fall more heavily on people with less income, while.

Tax Day 2016 Charts to Explain our Tax System Committee for a

(Archived Content)FROM THE OFFICE OF PUBLIC AFFAIRS js-1287 The individual income tax is highly progressive - a small group of higher-income taxpayers pay most of the individual income taxes each year. In 2001, the latest year of available data, the top 5 percent of taxpayers paid more than one-half (53.3 percent) of all individual income taxes, but reported roughly one-third (32.0 percent.

Who Pays Taxes? Foundation National Taxpayers Union

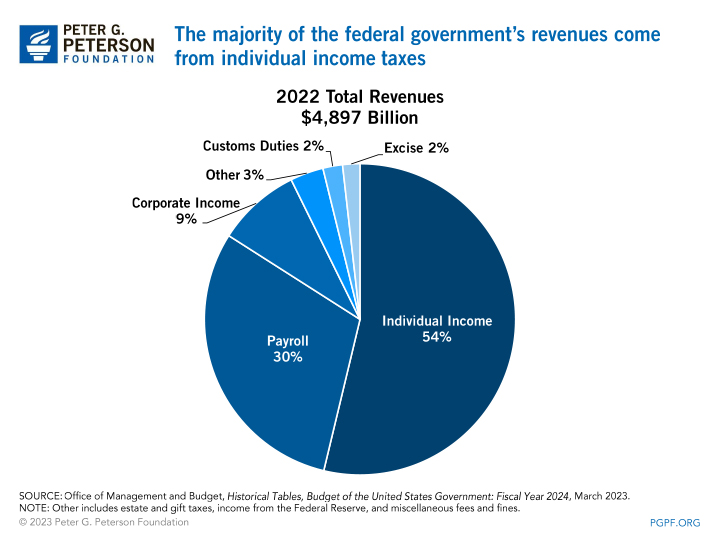

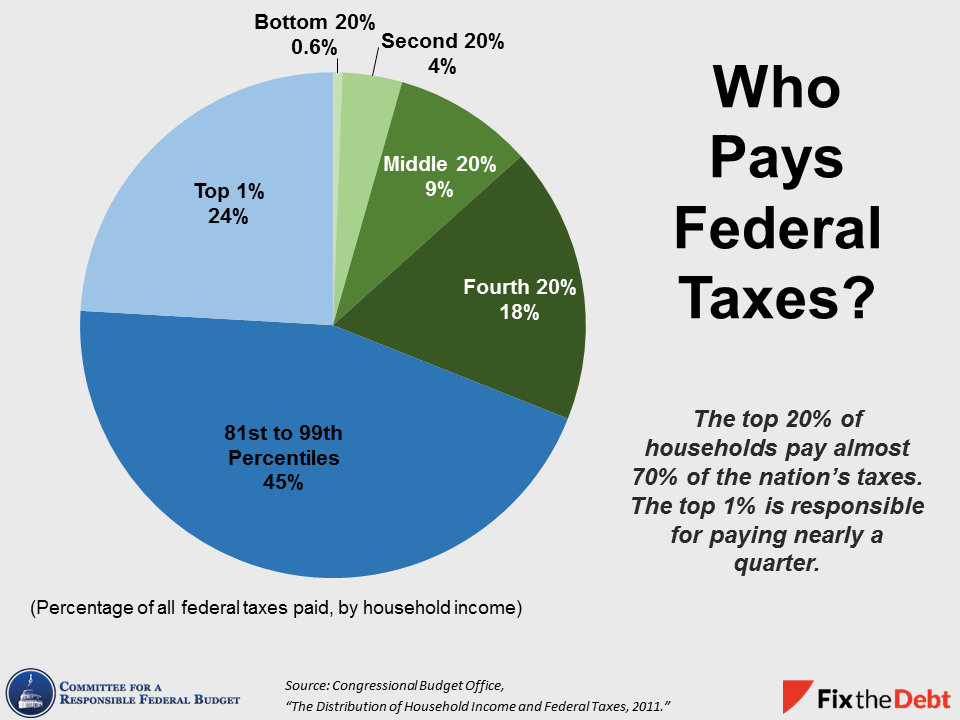

TPC estimates that 67 percent of taxes collected for 2022 came from those in the top quintile, or those earning an income above $189,200 annually. Within this group, the top one percent of income earners — those earning more than $982,600 per year — will contribute 26 percent of all federal revenues collected. While the fairness of the tax.

Summary of the Latest Federal Tax Data, 2020 Update Upstate

When all federal, state, and local taxes are taken into account, the bottom fifth of households pays about 16 percent of their incomes in taxes, on average. The second-poorest fifth pays about 21 percent. [8] It also is important to consider who the people are who do not owe federal income tax in a given year. TPC estimates show that 61 percent.

Where do people pay the most tax? World Economic Forum

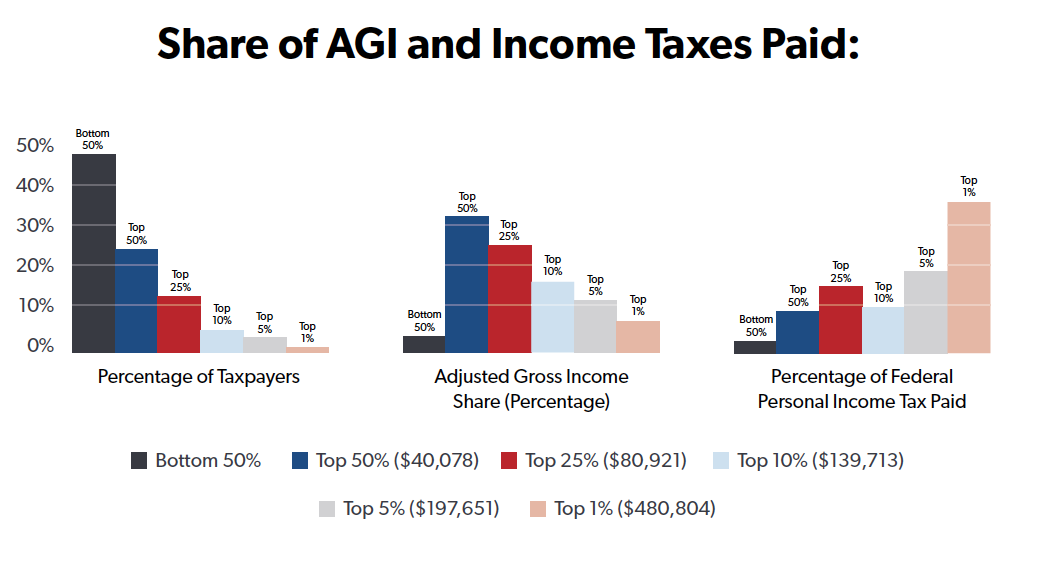

People with an AGI of $546,434 pay the most in federal income taxes. The U.S. tax system is generally progressive—the more you earn, the greater the percentage of your income is taxed by the IRS. In 2019, the top 1%, or taxpayers with an AGI of $546,434, paid $612 billion in income taxes, and paid 38.8% of all federal income taxes. To.

Who Pays Taxes in America in 2019? ITEP

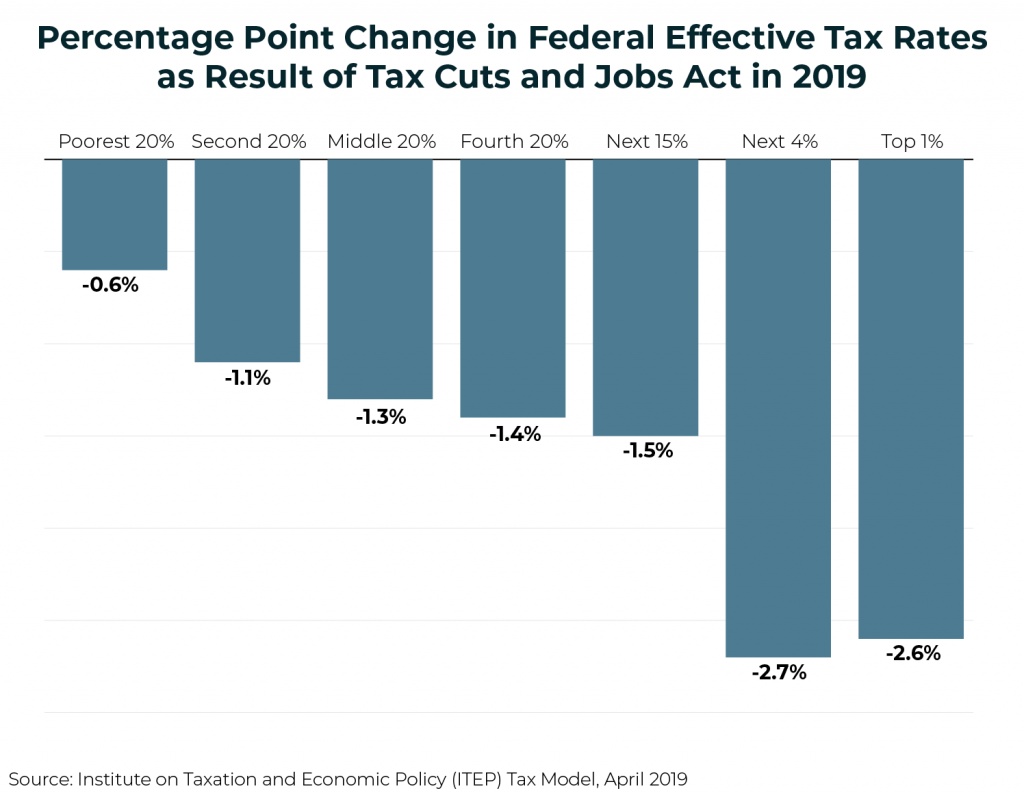

The Tax Cuts and Jobs Act Reduced Average Tax Rates across Income Groups The 2018 tax year was the first under the Tax Cuts and Jobs Act (TCJA). Due to the TCJA's changes, average tax rates fell for taxpayers across all income groups. Overall, the average tax rate for all taxpayers fell from 14.6 percent in 2017 to 13.3 percent in 2018.

Who Pays Taxes? Foundation National Taxpayers Union

That means about 892,000 Americans are stuck with paying 39 percent of all federal taxes. The top 10 percent of income earners, those having an adjusted gross income over $138,031, pay about 70.6.

Which States Pay The Most Federal Taxes? MoneyRates

Since 2001, the share of federal income taxes paid by the top 1 percent increased from 33.2 percent to a new high of 40.1 percent in 2018. In 2018, the top 50 percent of all taxpayers paid 97.1 percent of all individual income taxes, while the bottom 50 percent paid the remaining 2.9 percent. The top 1 percent paid a greater share of individual.

Budget Basics Who Pays Taxes?

The top 1 percent of taxpayers paid a 25.99 percent average rate, more than eight times higher than the 3.1 percent average rate paid by the bottom half of taxpayers. The top 1 percent's income share rose from 20.1 percent in 2019 to 22.2 percent in 2020 and its share of federal income taxes paid rose from 38.8 percent to 42.3 percent.

Budget Basics Who Pays Taxes?

The highest-earning hedge funder is Ken Griffin, founder of the Chicago-based firm Citadel. From 2013 to 2018, he reported an average income of nearly $1.7 billion, putting him fourth on the list.

Effective tax rates in the United States NewsPaperWay

The average income tax rate in 2021 was 14.9 percent. The top 1 percent of taxpayers paid a 25.9 percent average rate, nearly eight times higher than the 3.3 percent average rate paid by the bottom half of taxpayers. The top 1 percent's income share rose from 22.2 percent in 2020 to 26.3 percent in 2021 and its share of federal income taxes.