How To Trade Triple Bottom Chart Pattern TradingAxe

Triple Top and Triple Bottom Patterns. A triple top or triple bottom pattern is a chart feature which traders of an asset, such as Bitcoin (BTC), Ethereum (ETH) or other cryptoassets, can use to catch major trend changes. A comparatively rare phenomenon, a triple top or triple bottom can prove to be trend-defining events, especially on longer.

Triple Bottom Chart Pattern Definition With Examples

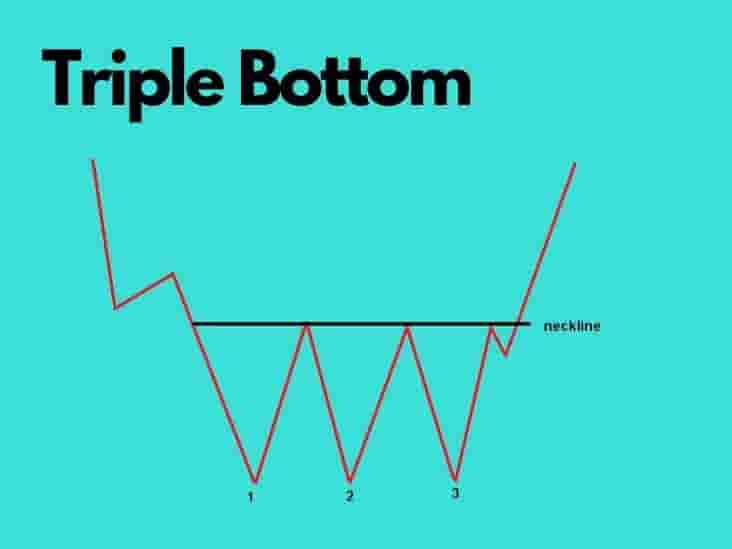

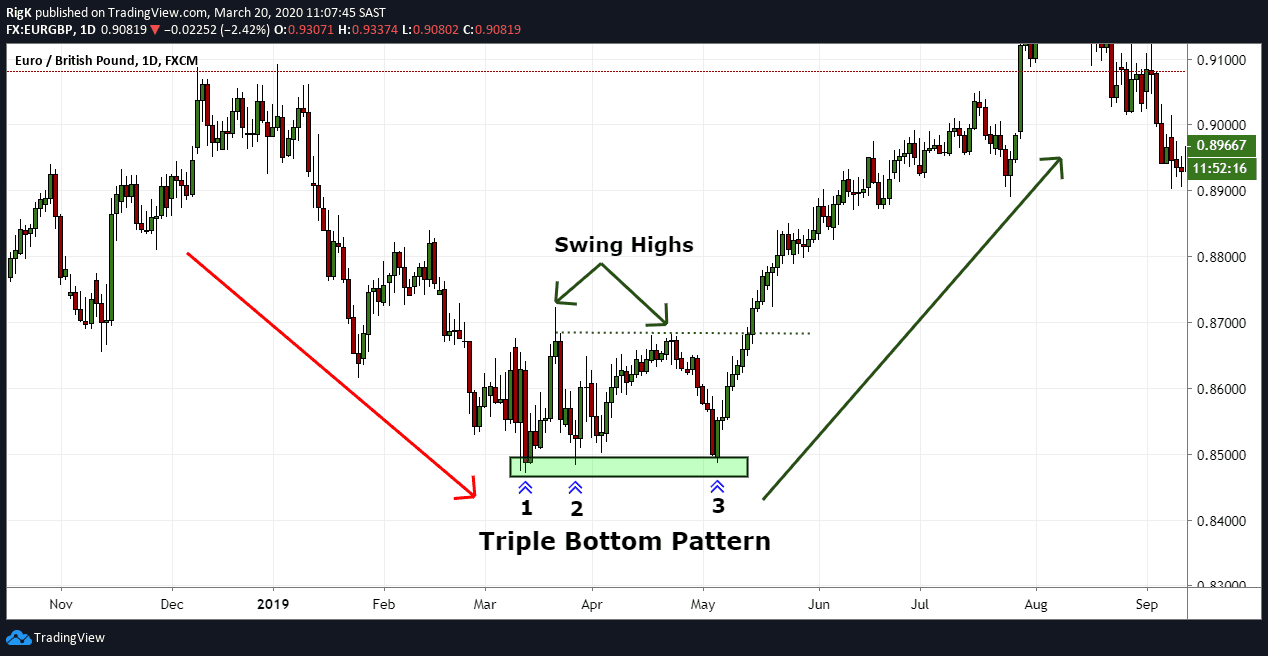

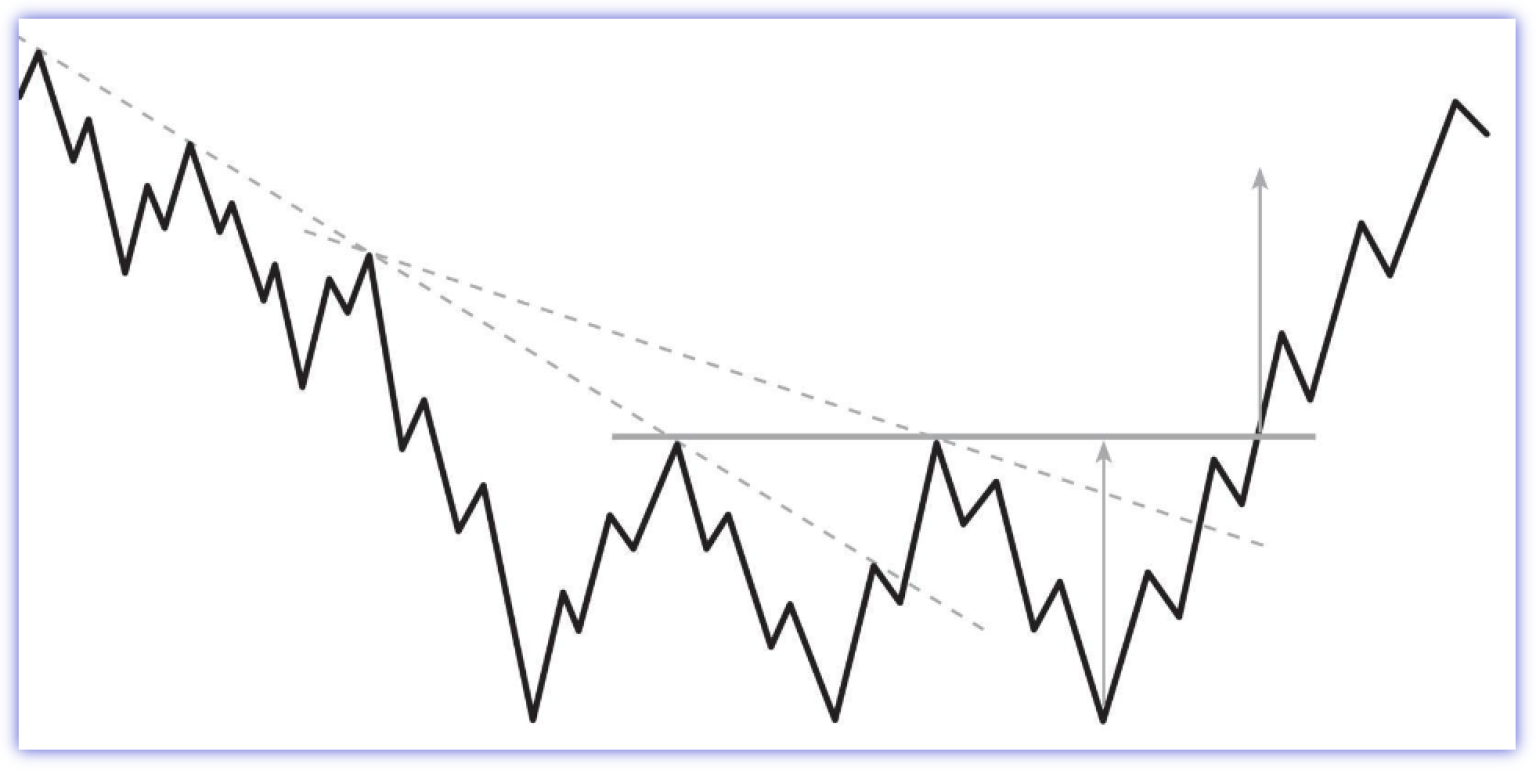

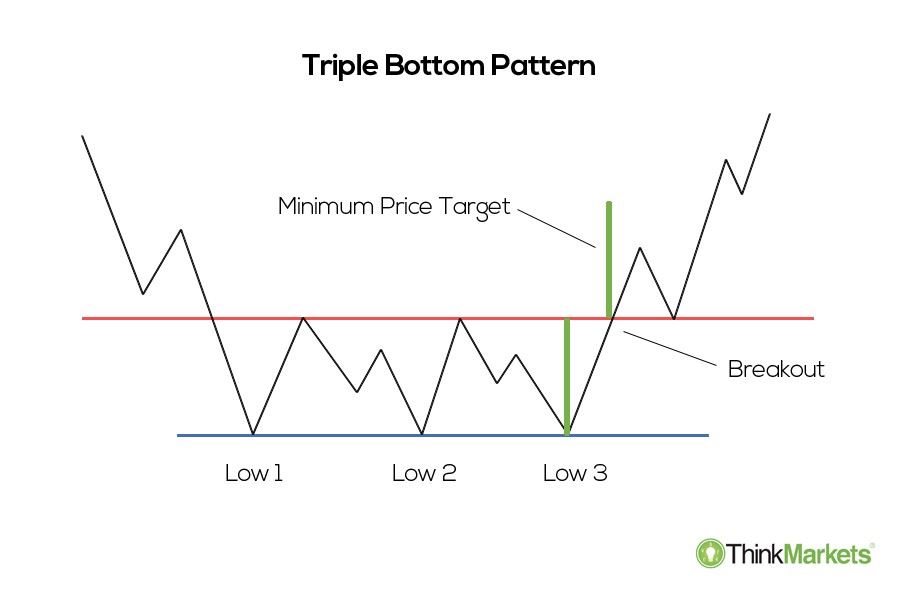

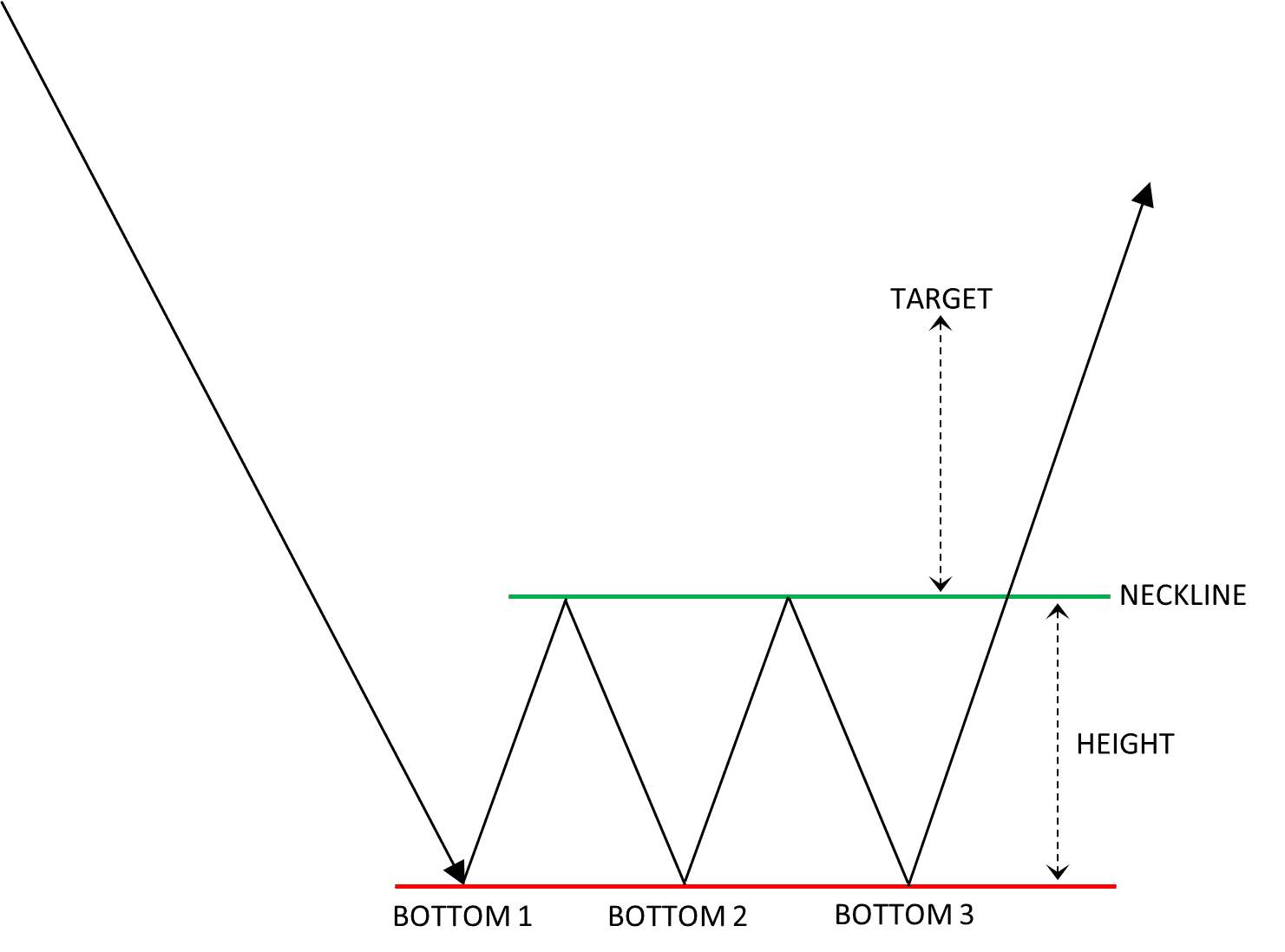

The triple bottom pattern is a key element in technical analysis, often signaling a potential reversal of a downtrend in financial markets. This bullish chart pattern emerges when an asset's price reaches three equal lows, followed by a breakout above the resistance level. Used by both novice and experienced traders, the triple bottom pattern.

Triple Bottom Pattern Explanation and Examples

A triple top is formed by three peaks moving into the same area, with pullbacks in between, while a triple bottom consists of three troughs with rallies in the middle. While not often.

Triple Bottom Pattern In Forex Identify & Trade Free Forex Coach

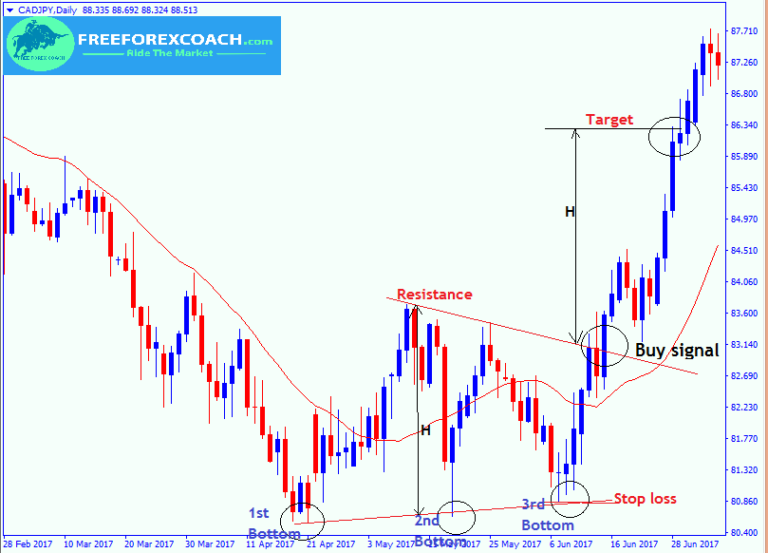

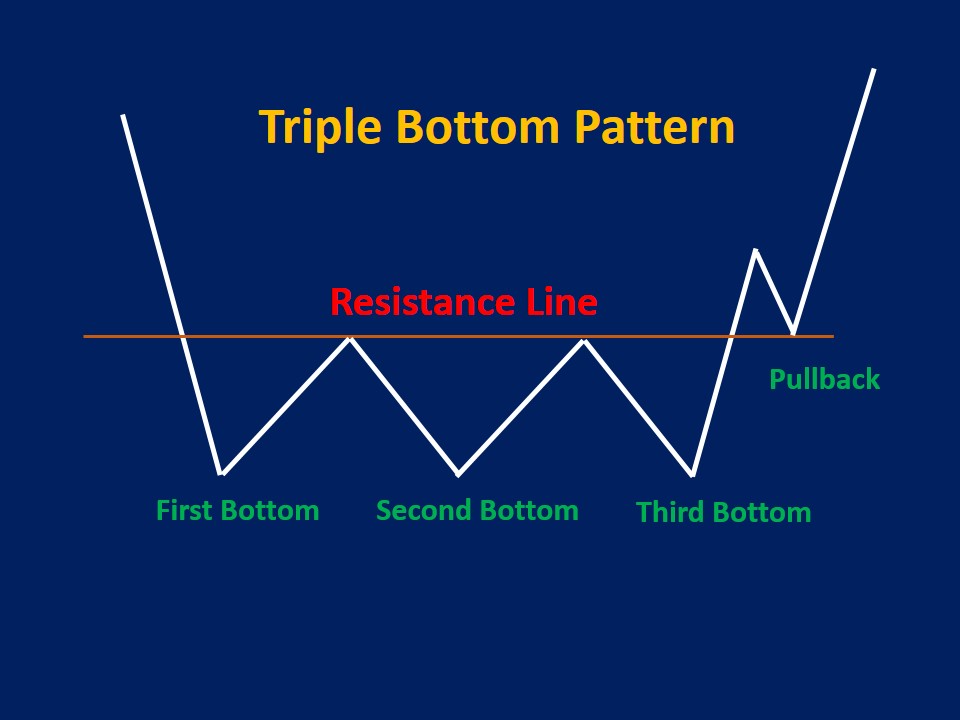

The triple bottom pattern is a bullish reversal chart pattern that is formed after a downward trend and is composed of three consecutive bottoms and a resistance neckline. Following the breakout, there's often a trend reversal and a bullish trend begin.

Triple Bottom Pattern A Reversal Chart Pattern InvestoPower

The triple bottom pattern can only be used as a reference for buy entries because it shows a bullish reversal and cannot be used as a reference for sell entries. How to Use the Triple Bottom Pattern. Regarding how to use the triple bottom pattern in trading, there are several strategies that traders must pay attention to, namely the following: 1.

The Triple Bottom Pattern is a bullish chart pattern. It occurs when there is a pattern of

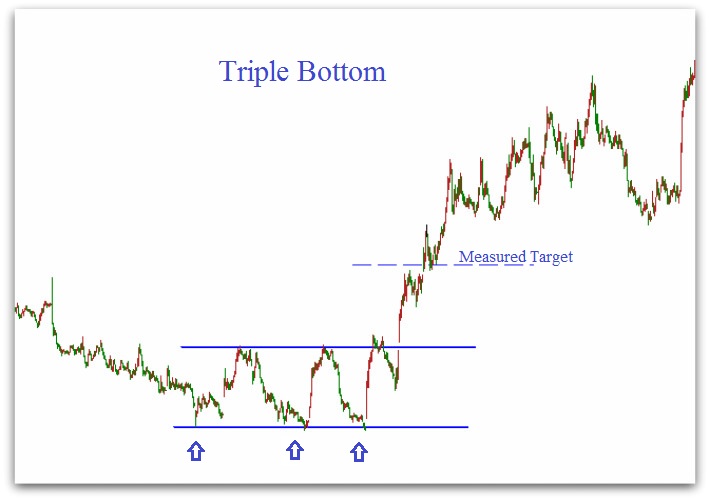

The triple bottom pattern is a strategy used by traders to capitalize on bullish momentum. It involves monitoring price action to find a distinct pattern before the price launches higher. The "triple bottom" name comes from the chart's shape before the price spikes.

Triple Bottom Pattern How to Trade & Examples

A triple bottom is a bullish chart pattern used in technical analysis that's characterized by three equal lows followed by a breakout above the resistance level. Key Takeaways A triple bottom.

The Triple Bottom Candlestick Pattern ThinkMarkets AU

The triple bottom chart pattern is a technical analysis trading strategy in which the trader attempts to identify a reversal point in the market. Traders look for three consecutive low points separated by intervening peaks, creating a "VVV" shape on the price chart.

The Triple Bottom Trading Chart Pattern in 2021 Trading charts, Technical analysis charts

A triple bottom pattern in trading is a reversal chart pattern in which price forms three equal bottoms consecutively and after neckline/resistance breakout, price changes bearish trend into a bullish trend. It is the most widely used chart pattern in forex/stocks trading and the most basic pattern in technical analysis.

The Triple Bottom Candlestick Pattern ThinkMarkets AU

Triple bottom patterns are a bullish pattern. It consists of three valleys or support levels. After the first valley is formed, the price rises quickly or gradually. After that, the price moves back down to the first valley level, and it holds that first support level, thus creating a double bottom.

Triple bottom is a bullish pattern that has a shape of “WV”. Strong support is indicated by

Chart patterns are extremely crucial for price action traders. They serve as a useful tool for predicting future price trajectories, and the triple bottom pattern is one of the most popular bullish reversal patterns.. Much like its twin, the triple top pattern, it is popular because its reliable, precise, and produces traders a respectable average profit.

Triple Bottom Pattern A Reversal Chart Pattern InvestoPower

A triple-top chart pattern is a bearish reversal chart pattern that is formed after an uptrend. This pattern is formed with three peaks above a support level/neckline. The first peak is formed after a strong uptrend and then retrace back to the neckline.

Triple Bottom Pattern Technical Resources

Triple Bottom Chart Pattern (The Essential Guide) Discover Professional Price Action Strategies That Work So You Can Profit In Bull & Bear Markets—Without Indicators, News, Or Opinions Get Your Copy Now (Risk-Free) Triple Bottom Chart Pattern (The Essential Guide) Last Updated: June 29, 2023 By Jet Toyco

How to Read the Triple Bottom Pattern? by FAMEEX Research Medium

The triple-bottom pattern tells traders a number of things. First, it tells them that the financial asset has found a strong support. In other words, bears are usually unable to move below the lower side of the support level. As such, if the price manages to move below the level, it can be a sign that the bullish view has been invalidated.

How to Trade with Triple Bottom Pattern Strategy • InvestLuck

What is the Triple Bottom pattern? The Triple Bottom compromises three bottoms or troughs in a downtrend and marks the change in trend from bearish to bullish. The formation of the Triple Bottom takes place when the price creates three troughs at an equal level. These troughs form a support level.

Triple Bottom Pattern, Triple Bottom Chart Pattern

A triple bottom is a reversal pattern, meaning that it is a signal of change in the current direction of a market or trend. It is one of the three major reversal patterns (along with a double bottom and head and shoulders, which are both reversal patterns as well).