Rising Wedge Pattern TUTORIAL for COINBASEBTCUSD by NodeInvestor

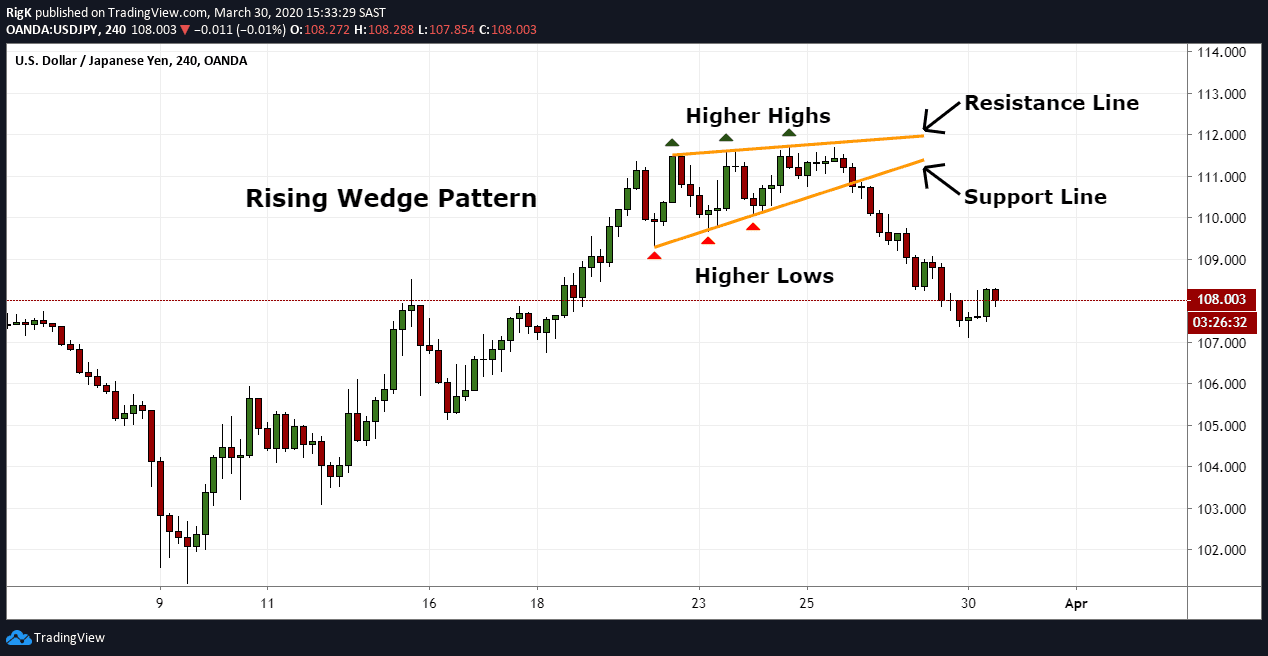

The rising wedge chart pattern is a recognisable price move that's formed when a market consolidates between two converging support and resistance lines. To form a rising wedge, the support and resistance lines both have to point in an upwards direction and the support line has to be steeper than resistance. Like head and shoulders, triangles.

Rising Wedge — Chart Patterns — Education — TradingView

The rising wedge is a bearish chart pattern found at the end of an upward trend in financial markets. It suggests a potential reversal in the trend. It is the opposite of the bullish falling wedge pattern that occurs at the end of a downtrend. Traders recognize the rising wedge as a consolidation phase after a medium to. 19 6

Ascending Wedge Pattern Advanced Forex Strategies

The forex rising wedge (also known as the ascending wedge) pattern is a powerful consolidation price pattern formed when price is bound between two rising trend lines. It is considered a bearish.

Rising Wedge Pattern Bearish Patterns ThinkMarkets EN

The rising wedge pattern is used in financial markets to identify potential trend reversals. It consists of converging trendlines that slope upward, with the lower trendline rising at a steeper angle than the upper one.

Using the Rising Wedge Pattern in Forex Trading

The rising wedge pattern, in particular, stands as a beacon in the sea of market analysis, guiding traders through the ebb and flow of price movements. Known for its distinct shape, this pattern is a key to unlocking understanding of market psychology, pointing to both imminent reversals and possible continuities in price trends..

Stock Market Chart Analysis Rising Wedge of S&P 500

The rising wedge is a technical chart pattern used to identify possible trend reversals. The pattern appears as an upward-sloping price chart featuring two converging trendlines. It is.

Rising Wedge Pattern How to Identify a Selling Opportunity Bybit Learn

A rising wedge is a bearish pattern that signals that the market is going to continue downwards , or turn bearish, depending on the previous trend direction. However, some traders choose to regard the rising wedge as a bullish pattern, if the conditions are right.

Trading method Rising Wedge — Cryptomunity.eu

The Rising Wedge is a bearish pattern that begins wide at the bottom and contracts as prices move higher and the trading range narrows. In contrast to symmetrical triangles, which have no definitive slope and no bullish or bearish bias, rising wedges definitely slope up and have a bearish bias.

The Rising Wedge Pattern Explained With Examples

The rising wedge pattern is a very common formation that appears in any market and timeframe. This chart pattern can be seen as a bearish reversal pattern after an uptrend or as a trend continuation pattern during a downtrend.

The Rising Wedge Pattern Explained With Examples

April 19, 2023 According to multi-year testing, the rising wedge pattern has a solid 81% success rate in bull markets with an average potential profit of +38%. The ascending wedge is a reliable, accurate pattern, and if used correctly, gives you an edge in trading.

Wedges Price Pattern

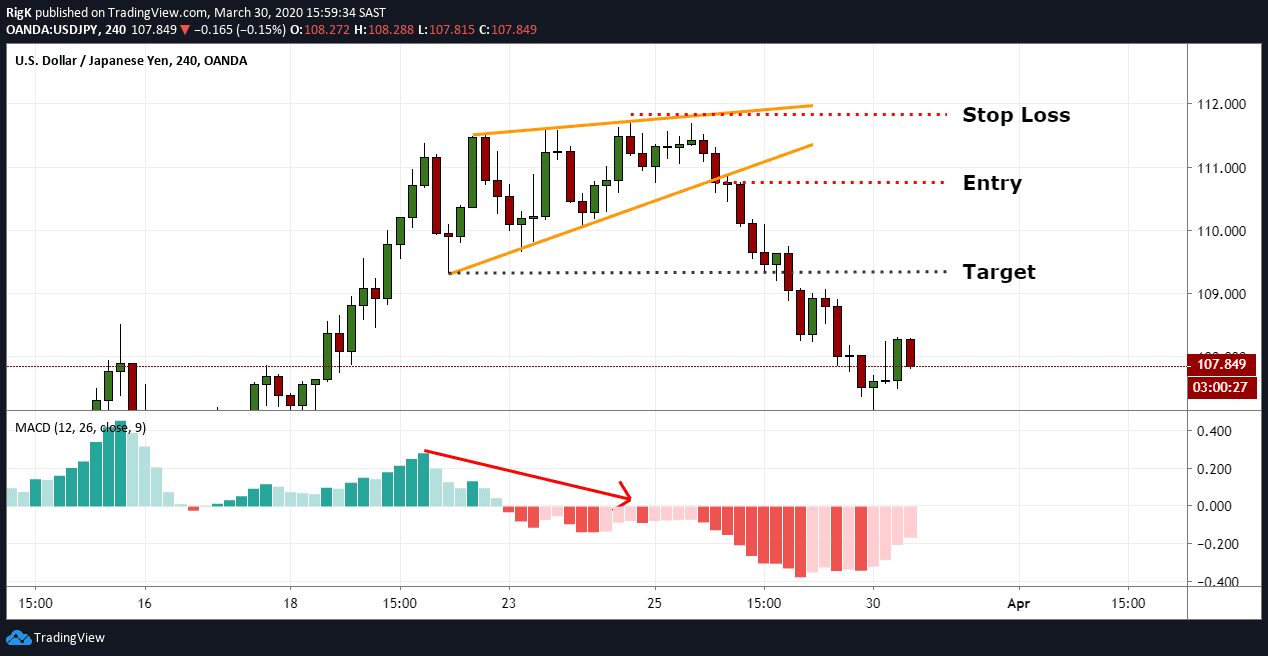

Therefore, rising wedge patterns indicate the more likely potential of falling prices after a breakout of the lower trend line. Traders can make bearish trades after the breakout by selling.

The Rising Wedge Pattern Explained With Examples

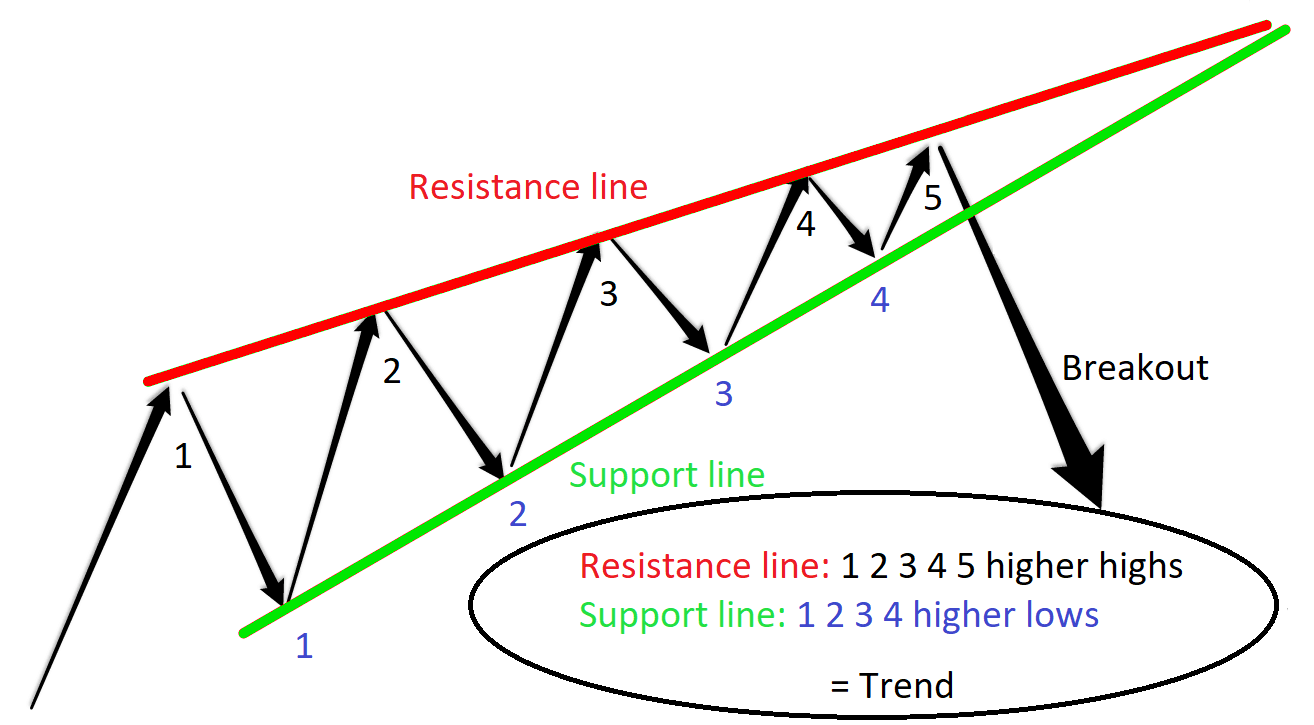

A rising wedge pattern consists of a bunch of candlesticks forming a big angular wedge that is increasing price. It is a bullish candlestick pattern that turns bearish when the price breaks out of a wedge. Rising wedge patterns form by connecting at least two to three higher highs and two to three higher lows, becoming trend lines.

How to Trade the Rising Wedge Pattern Warrior Trading

A rising wedge is a chart pattern found in the context of an upward-trending market and is often regarded as a bearish reversal pattern. It is characterized by a narrowing price range between upward-sloping support and resistance lines, which shows that higher highs and higher lows are being formed at a diminishing rate. The converging of these.

5 Chart Patterns Every Beginner Trader Should Know Brooksy

To make things clear and organized, you are advised to follow the steps below in order to identify and use the rising wedge bearish reversal pattern in trading. Identify an existing trend in a currency pair. Draw support and resistance two trend lines along with the highs and lows of the trend. Wait for a price consolidation and the contraction.

Cool Rising Wedge Pattern Adalah References Blog Ekspor Impor Indonesia

The rising wedge pattern, while a potent tool in a trader's arsenal, requires proper confirmation to ensure its validity and to mitigate potential false signals. Confirmation is the trader's safeguard, ensuring that the pattern observed is not just a fleeting formation but a genuine indicator of an impending market move.

How To Trade With Falling & Rising Wedge Pattern ELM

The rising wedge is a technical trading indicator that signals trend reversals or continuations, usually within bear markets. The pattern is also known as "ascending wedge" due to the way it appears on a chart. The ascending wedge pattern can form when the stock is either in an uptrend or a downtrend market.