Sample Term Sheet Convertible Loan Agreement PDF Loans Stocks

A convertible loan seems quick and easy to arrange: no extensive paperwork required and involvement of a civil law notary isn't necessary (yet). Several template agreements are easily accessible online. At face value, the convertible loan appears the simplest and cheapest way of financing. However, a convertible loan is not necessarily cheaper.

Convertible Loan Term Sheet PDF Financial Transaction Loans

A convertible loan agreement is a type of agreement between a lender and borrower in which the loan can be converted into equity in the future. This type of agreement can be beneficial for both the lender and borrower, and can be structured in a way that works for your business. The benefits of a convertible loan agreement include: 1.

Convertible Loan Agreement Template Resume Examples

a convertible loan agreement can be downloaded below for free. This is the long-form version of the CLA Model Documentation and as such aims to reflect customary terms typically agreed upon for convertible loans granted by institutional investors. Amongst other rele-vant assumptions underlying the model documentation, it assumes that:

Convertible Loan Agreement Template

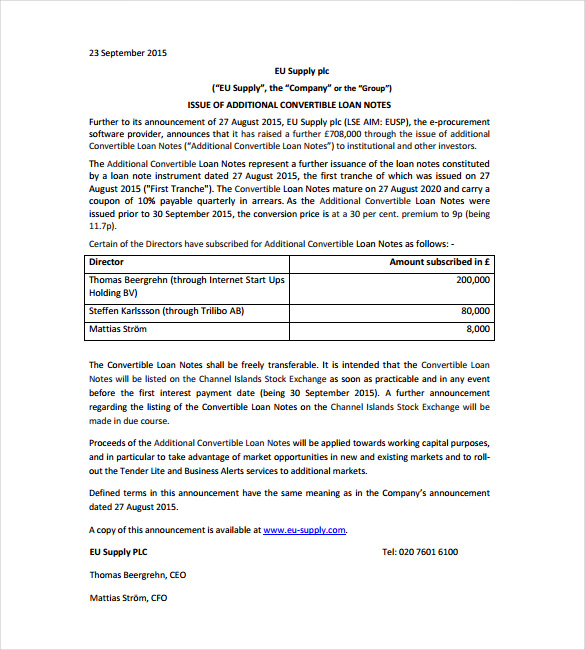

Other important terms. Interest: Usually the convertible loan also carries interest, say, 2% (or a similar figure corresponding to current interest rates), that will accrue from the date of the investment until the conversion date.Sometimes, the rate is 0% but it can also be as high as 10% if the startup is in a weak position. In any case, the rates usually seen in convertible loans are.

Convertible Loan Agreement AustrianStartups

Convertible Loan — is a financial instrument typically used for investments in early-stage companies and startups. However, many entrepreneurs still don't know what it is and how it works.

7+ Convertible Note Agreement Templates Sample Templates

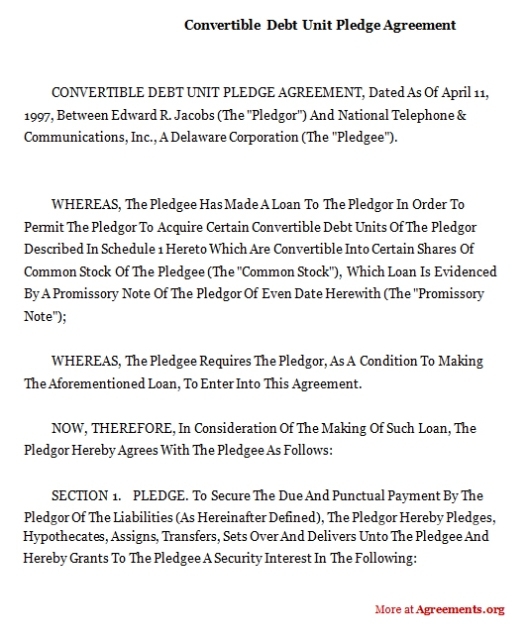

Under a convertible loan agreement, the lender requires the borrower (a non-public joint-stock company) to convert the loan, i.e. place additional shares of a certain category (type) to the lender instead of returning all or part of the loan amount and paying all or part of the loan interest when due or when other circumstances specified in the agreement arise.

Convertible Loan Agreement Template

To enter into a convertible loan agreement, a shareholder resolution is required. This typically requires a simple majority in the shareholders' meeting, usually composed of the founders (in the case of a startup). Execution of the convertible loan agreement. With the approval of the shareholders' meeting, the convertible loan agreement can.

CONVERTIBLE LOAN AGREEMENT * * * Agreement Agreement Date A) B) Fill and Sign Printable

For instance, consider a principal amount of CHF 1'000'000 with an applied interest rate of 3%. After two years, the total loan amount accrues to CHF 1'060'000. As a practical advice, we commonly observe either zero interest or a rate ranging from 1-3%. However, we recommend concentrating more on understanding and managing the discount.

Convertible Loan Agreement Template

The convertible loan agreement will also specify the circumstances in which the debt needs to be repaid. Typical terms that trigger repayment of the loan include: a material breach of terms of the convertible loan agreement; passing the maturity date when no new funding round has happened (unless your terms specify this triggers conversion).

Convertible loan agreement for companies (non

1. TOTAL AMOUNT OF LOAN 1.1. The total amount of the loan is US$ ( US Dollars) 1.2. Lender is under no further obligation to advance any additional funds to Blackcommerce 2. TERM OF THE LOAN 2.1 The Term of the Loan shall be 5 years from the date of receipt of the funds. 3. DELIVERY OF FUNDS BY LENDER

Convertible Loan Note Template

Edit, Fill & eSign PDF Documents Online. No Downloads Needed. Get Started Now. Best PDF Fillable Form Builder. Professional Toolset. Quick and Simple. Subscribe for more

Convertible Loan Note Template

Convertible loan notes allow companies quick access to cash (often in anticipation of an equity funding round completing at a later date). But as with any commercial loan (and particularly because the loan is capable of converting to equity), there are a number of key terms to be considered and negotiated between the relevant parties .

FREE 7+ Sample Business Loan Agreement Templates in PDF MS Word

A convertible note agreement is an agreement made between a lender and a company in which a lender receives stock in the company rather than the repayment of the money loaned. When an investor issues a convertible note to a startup, the debt is automatically converted into stock shares after the closing of a Series A round of financing.

FREE 9+ Sample Convertible Note Agreement Templates in PDF MS Word Google Docs Pages

Convertible debt definition . With convertible debt, a business borrows money from a lender or investor where both parties enter the agreement with the intent (from the outset) to repay all (or part) of the loan by converting it into a certain number of its preferred or common shares at some point in the future. The agreement specifies the repayment and conversion terms which include the.

Convertible Loan Agreement Template

In other words, convertible notes are loans to early-stage startups from investors who are expecting to be paid back when their note comes due. But, instead of being paid back in principal with interest—as would be the case with a typical loan—the investor can be repaid in equity in your company. You might also think of a convertible note.

Convertible Loan Agreement Template

What is a convertible loan? A convertible loan is a loan which will either be repaid or, in most cases, convert into equity at a future date.. Clawback agreements: the pros and cons of their.